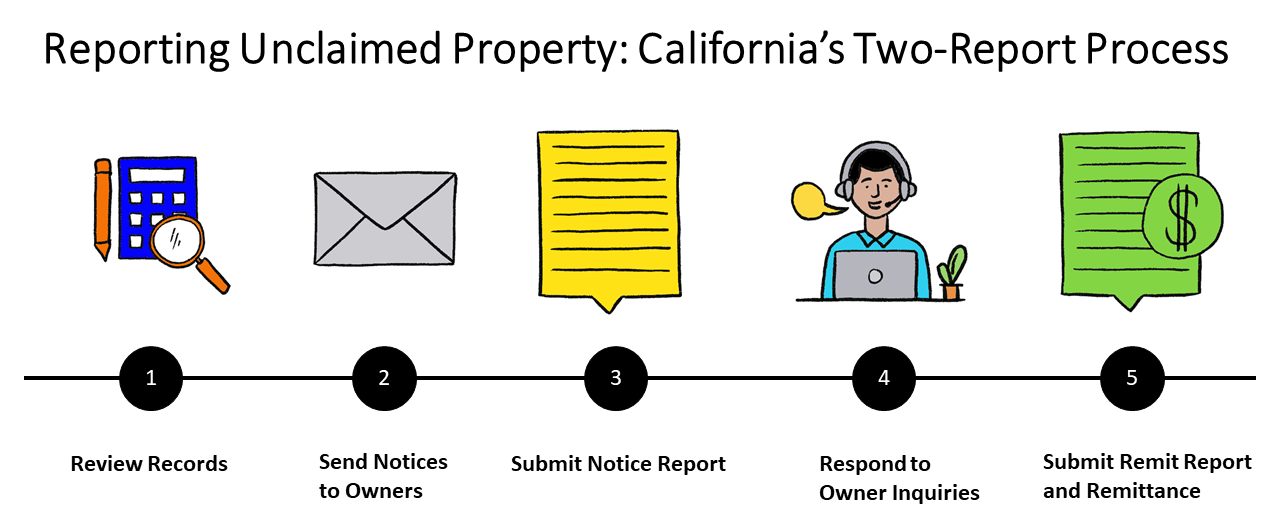

How to Report

Step 1: Review Records

Identify Unclaimed Property

The first step of the reporting process is to search your books and records to identify any unclaimed property in your possession. Consult our Dormancy Periods Table and Property Reporting Cycles for help in determining when a property is reportable, and refer to the Property Codes with Dormancy Periods guide for standard NAUPA II reporting codes.

Step 2: Due Diligence

Due Diligence: Mail Notices to Property Owners

California Unclaimed Property Law requires businesses to notify property owners by mail if they have property that will become reportable within 6-12 months. Consult our Guide to Due Diligence for guidance on this process.

The Controller’s Office has created sample letters to assist the property owner outreach process. However, holders should refer to California Code of Civil Procedure Sections 1513.5, 1514, 1516(d), and 1520(b) for the complete requirements for notifying owners of unclaimed property.

- Sample Due Diligence Letter - Pre-written letter holders can use to perform their due diligence.

- Sample Due Diligence Letter for Safe Deposit Box Contents – Pre-written letter holders can use to perform due diligence for unclaimed safe deposit boxes or safekeeping repositories.

Step 3: Notice Report

*Due Before May 1 for Life Insurance Companies

The purpose of the Notice Report is to notify the State Controller of any unclaimed property on your books. Do not remit property at this time. The Notice Report consists of property owner details in standard NAUPA-II format. Free reporting software is available to compile and properly format property owner details. Submit the Notice Report online before November 1. Life insurance companies must submit Notice Reports before May 1. Holders participating in the Voluntary Compliance Program (VCP) will have alternate deadlines specified in form VCP 02. For questions about your report, email our Reporting Unit at UCPReporting@sco.ca.gov.

Notice Report Information, Forms, and Resources

Free Reporting Software – This site includes links to free software that can be used to report unclaimed property.

Property Codes with Dormancy Periods – Types of reportable property with their corresponding codes (required for reporting) and dormancy periods

Property Reporting Cycles – Charts used to determine when unclaimed property is reportable

Dormancy Periods Table – Dormancy periods for most frequently reported unclaimed property types

Step 4: Respond to Owners

Respond to Owner Inquiries

After submitting the Notice Report, the State Controller sends out its own notices to owners of unclaimed property instructing them to contact you, the holder, to claim their property before it is remitted to the State. The State Controller’s Office recommends training designated staff to respond to these inquiries, verify ownership, and reunite the property with the owner.

Step 5: Remit Report and Remittance

The purpose of the Remit Report is to notify the State Controller of any unclaimed property listed in your Notice Report that remains on your books, and to transfer or remit that property to the Controller. The Remit Report consists of updated property owner details and remittance. SCO will specify Remit Report deadlines in the Notice Report email confirmation. The standard deadline is between June 1-15, or December 1-15 for life insurance companies. Holders enrolled in the VCP will have alternate deadlines specified on form VCP 02. Submit the Remit Report online according to your deadline and remit the property within this timeframe. For questions about your report, email our Reporting Unit at UCPReporting@sco.ca.gov.

Remit Report Information, Forms, and Resources

Free Reporting Software – This site includes links to free software that can be used to report unclaimed property.

Securities Summary (SS-1) - Required when remitting securities

Estates of Deceased Persons – Report of Cash and Personal Property Absent Heirs or Claimants (UPD-221 Form) – Required when remitting estate funds

Remitting Unclaimed Property

Holders must transfer or remit unclaimed property to the State Controller when they submit the Remit Report. For remittance amounts totaling $2,000 and over, register with the State Controller’s EFT Help Desk, preferably by April 30, and remit property via Electronic Funds Transfer. Only remittance amounts under $2,000 may be submitted via check.

Remittance Information, Forms, and Resources

Guide to Remitting Property

Remitting Property via Electronic Funds Transfer (EFT): Guide to transferring property to the Controller using EFT.

EFT-1 Form: Authorization Agreement for Electronic Funds Transfer - Establish or change electronic funds transfer account

EFT-3 Form: Registration for Remittance by Fedwire - Establish or change Fedwire account

Other Report Types

Supplemental Reports

Holders must report properties not included on their original Notice Report on a Supplemental Notice Report. SCO sends a notice to the owner to give them the opportunity to claim their property from the holder before it is transferred to the state. SCO will notify holders via a Remit Reminder Letter (14F) identifying the Remit Report due date for the properties on the Supplemental Notice Report. If the 14F is not received within six months of filing the Supplemental Notice Report, holders should contact the Reporting Unit at (916) 464-6284 or UCPReporting@sco.ca.gov.

Out of Business Reports

Entities closing their books and records due to the dissolution of business may submit a Remit Report without waiting for standard dormancy periods to apply, without completing due diligence notifications, and without submitting a Notice Report. Out of business holders may submit a Remit Report for property unclaimed within six months of the date of final distribution or liquidation.

Nil Reports

A Nil Report indicates the business has no property to report to California or has reunited all property reported on the Notice Report to its rightful owner. Businesses that do not have reportable unclaimed property are not required to submit a Nil Report unless they have received a written request from SCO to report. However, businesses that reunite all properties reported on their Notice Report are still expected to submit a Nil Report. SCO recommends that holders file a Universal Holder Face Sheet (UFS-1) every year, regardless of whether they have unclaimed property to report.

Reporting Resources

Free Reporting Software - Software to report unclaimed property

5 Steps to Reporting Unclaimed Property - Quick guide through the reporting process

Reporting Quick Guides - Brief reference guides to assist holders with California's reporting process

Standard National Association of Unclaimed Property Administrators (NAUPA II) Codes with Property Dormancy Periods - Required codes for completing owner detail information

Property Reporting Cycles - Charts used to determine when unclaimed property is reportable

Dormancy Periods Table - Dormancy periods for most frequently reported unclaimed property types