Press Releases

Controller Malia M. Cohen Issues March Cash Report

Revenues and Spending Continue to Meet Expectations, All Eyes on Critical Revenue Collections in the Months Ahead

4/11/2025

916-201-9261

scocomm@sco.ca.gov

SACRAMENTO — State Controller Malia M. Cohen released her monthly cash report covering the state’s General Fund revenues, disbursements and actual cash balance for the fiscal year through March 31, 2025.

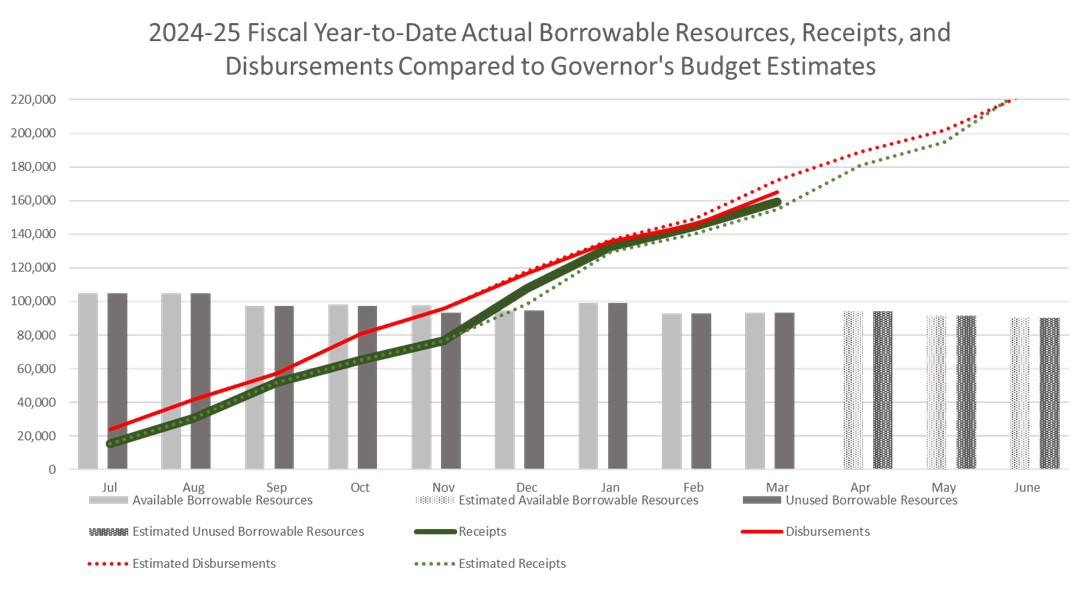

As noted in the Controller’s Monthly Statement of General Fund Cash Receipts and Disbursements, receipts for the fiscal year through March were higher than estimates contained in the 2025-26 Governor’s Budget by $4.5 billion, or 2.9 percent. Fiscal year-to-date expenditures were $6.9 billion, or 4 percent, lower than Governor’s Budget estimates.

“March and fiscal year-to-date revenues continue to run marginally higher than budget expectations and the state continues to maintain a strong cash position to support the state’s payment obligations,” said Controller Cohen. “However, because significant revenue collections are expected in the remaining three months of the fiscal year, coupled with current economic conditions, I caution against being lulled into a false sense of security.”

For the fiscal year through March, personal income tax receipts were $3.6 billion above Governor’s Budget projections, or 4.3 percent. Corporation tax collections were $415.9 million, or 1.9 percent below estimates. Retail sales and use tax receipts were $400.5 million below recent projections, or 1.6 percent.

The Governor’s Budget estimates that the state will collect $17.4 billion in personal income taxes in April. The State Controller’s Office is posting daily personal income tax receipts and withholding totals net of refunds on its April 2025 Personal Income Tax Tracker webpage.

While April 15 is the traditional annual personal income tax payment deadline, the Franchise Tax Board extended the current deadline for Los Angeles County individuals and businesses in response to the fires that began on January 7, 2025. These individuals and businesses have until October 15, 2025, to file and pay taxes.

As of March 31, the state had $93.2 billion in unused borrowable resources. These resources are from internal funds outside of the General Fund that are borrowable under state law and that the State Controller’s Office uses to manage daily and monthly cash deficits when revenue collections are lower than expenditures. Internal borrowing from special funds is short-term and is repaid so that borrowing does not affect the operations of the special funds.

Summary Chart follows:

As the chief fiscal officer of California, Controller Cohen independently oversees and manages California’s financial resources with integrity and transparency to build trust. The Controller is responsible for accountability and disbursement of the state’s financial resources. The Controller has independent auditing authority over government agencies that spend state funds. She is a member of numerous financing authorities, and fiscal and financial oversight entities including the Franchise Tax Board. She also serves on the boards for the nation’s two largest public pension funds. Follow the Controller on X at @CAController and on Facebook at California State Controller’s Office.

###