You can also view this newsletter as a PDF.

Extension of Operations at Diablo Canyon Plant

Exposes Risks and Raises Tough Questions

In response to forecasted grid instability, the governor recently called for an urgent five-year extension of operations at Diablo Canyon Power Plant (DCPP), the leases for which were set to expire in phases by 2025. Senate Bill 846 (Dodd, Ch. 239 of 2022), which authorized the extension, was passed and signed into law in the final hours of the legislative session. The next twelve months – as the state implements the requirements of the bill – will be critical to ensuring the state’s continued grid reliability.

Controller Yee is mindful that the agencies responsible must maintain an open, inclusive, and data-driven decision-making process. Simultaneously, California must keep an eye toward learning from this experience to avoid future risks from emergency policy decisions.

When Pacific Gas & Electric (PG&E) sought to forgo relicensing and pursue decommissioning of DCPP in 2016, Controller Yee led the State Lands Commission in safeguarding protections for ratepayers, workers, and the environment; she remains committed to these values. As the state shifts gears to take the next steps in assessing DCPP’s continued operations, California must maintain its position as a global climate leader and a model for good governance. Importantly, state policymakers must focus on thoroughly addressing outstanding questions to ensure a transparent, accountable process that is fair to all.

What is the true cost of keeping DCPP online for an additional five years?

The total price tag is still unknown. Through SB 846, the legislature committed $1.4 billion in the form of a potentially forgivable loan, with up to $600 million appropriated now and $800 million requiring future legislative action. PG&E also is competing for up to $1.2 billion from the federal Civil Nuclear Credit (CNC) program and may be eligible for other government funding, such as the $75 million set aside for retiring energy plants in Assembly Bill 205 (Committee on Budget, Ch. 61 of 2022) and up to $4.8 billion in future CNC award cycles.

How much of the cost of keeping DCPP online will be taxpayer-funded?

The fiscal impact of this action to California taxpayers and ratepayers remains unclear. There are ratepayer protections written into SB 846, but with state and federal funds involved, there will be a cost to taxpayers. With more than $1 billion already committed, Controller Yee believes it is critical that PG&E and state leaders provide a clear accounting of public dollars spent and planned, and establish mechanisms for averting inequitable impacts.

How does SB 846 compare to other investments in renewable energy and storage?

SB 846 requires a cost analysis comparing the DCPP extension to alternative options by September 30, 2023. By the time this analysis is published, it is likely that substantial funding already will be invested in the extension. A comprehensive analysis that uniformly evaluates all options is crucial for a successful outcome without unintended consequences. For example, the legislation extends DCPP's once-through cooling compliance date, which reduces capital expenditures by billions of dollars. If reasonable exemptions exist for alternative energy solutions that may reduce capital expenditures, these should be considered for a more complete analysis.

How will SB 846 affect the development and deployment of renewables?

California has an ambitious goal of achieving 100-percent clean energy by 2045. The state must ensure extended DCPP operations will not interfere with meeting the urgent need for renewable energy.

SB 846 allocates $1 billion over three years to support renewable and clean energy resources, reduce greenhouse gas emissions, and retain grid reliability. These groundbreaking investments, along with permitting reform and other measures passed by the legislature this year, can support and accelerate the transition from fossil fuel dependence.

However, some planned renewable projects already on track for grid connection may be postponed or canceled due to the extension of DCPP operations. Developers assumed DCPP’s retirement would free up space on the grid by 2025, and numerous renewable projects have accumulated in a queue awaiting grid connection. Beyond funding, there are process and planning issues to resolve.

Who should be at the table for these decisions, and who has been left out?

Transparency and inclusion are critical to good public policy. So far, the decision to extend DCPP operations has primarily taken a top-down approach, with minimal public input. Controller Yee strongly believes the public must have ongoing opportunities for meaningful engagement throughout the process, with particular attention to communities historically excluded from such discussions. Robust engagement centered on equity creates a pathway for identifying potential negative social and environmental impacts prior to implementation.

What can be done to avoid this type of emergency decision-making in the future?

Controller Yee wants to see future planning prioritize demand-side action, in parallel with increasing renewable energy supply. Reducing overall energy usage through efficiency and conservation measures not only lessens stress on the grid, but also saves taxpayer dollars. During September’s record heatwave, California managed to keep the lights on through a combination of renewables, battery storage, and – perhaps most notably – incredible demand-side conservation from customers. Californians widely heeded the state’s call to adjust their thermostats and not use major appliances during peak hours to avoid rolling blackouts. Regularly placing such value on energy efficiency and conservation would go a long way toward reducing energy imports and natural gas reliance during peak periods, providing a tremendous opportunity for every Californian to be part of the solution.

As California aims toward the bold clean energy goals established in SB 1020 (Laird, Ch. 361 of 2022), it is critical state energy leaders conduct the appropriate planning – based on reliable data and the best available science – to ensure grid reliability. Moving forward, Controller Yee wants to see future energy decisions grounded in equity, accountability, and transparency, with an integrated understanding of the impacts to ratepayers and taxpayers.

Property Tax Initiative Changes Benefits for Property Transfers

In November 2020, California voters narrowly passed a measure intended to bring property tax savings to older homeowners, more revenue for fire districts, and greater mobility for wildfire victims. Proposition 19 – the Home Protection for Seniors, Severely Disabled, Families, and Victims of Wildfire or Natural Disasters Act – was widely supported by realtors and firefighters and received just over 51 percent of the vote.

In November 2020, California voters narrowly passed a measure intended to bring property tax savings to older homeowners, more revenue for fire districts, and greater mobility for wildfire victims. Proposition 19 – the Home Protection for Seniors, Severely Disabled, Families, and Victims of Wildfire or Natural Disasters Act – was widely supported by realtors and firefighters and received just over 51 percent of the vote.

Enactment of Prop. 19 made dramatic changes to long-standing property tax benefits available under California law. The effects of which have implications for estate planning and intergenerational transfers. The initiative added, among other provisions, section 2.1 to Article XIII A of the California Constitution, implementing changes to base year value transfers and to the parent-child exclusion. A base year value transfer allows for the carryover of the property tax basis (i.e., assessed value) from a homeowner’s current residence to their new residence. The parent-child exclusion allows for the carryover of the assessed value of a property from parents to their children. A brief history will provide some context for understanding Prop. 19’s changes.

History of Base Year Value Transfers

In November 1986, California voters passed Proposition 60, to allow a person over the age of 55 who sells their primary residence to transfer its base year value to a dwelling of equal or lesser value they purchase or have built in the same county (intracounty) within two years of the sale. In November 1988, voters widely supported Proposition 90, which extended the benefits of base year value transfers from one county to another within California (intercounty), if the county where the replacement home is located has adopted an ordinance to participate in the program. Finally, in November 1990, California voters overwhelmingly passed Proposition 110, extending the benefits of base year value transfers to homeowners with severe disabilities. This initiative received 80-percent voter approval.

History of the Parent-Child Transfer Exclusion

In November 1986, California voters passed Proposition 58, declaring that transfers of real property between spouses or between spouses and their children – as well as the first $1,000,000 of other real property between parents and their children – did not constitute a change in ownership. In other words, when real property would transfer as such, it would not be subject to a reassessment. Other real property that parents might transfer could include rental property, vacation property, or business property (such as a family business). In March 1996, California voters passed Proposition 193, extending the benefits of the parent-child transfer exclusion to grandparents and grandchildren, if the children's parents had passed away.

Assessed Value Transfers and Proposition 19

In terms of base year value transfers, Prop. 19 – as implemented by Revenue & Taxation Code section 69.6 – is an improvement upon prior law (Props. 60, 90, and 110 as implemented under Rev. & Tax. Code section 69.5). Prior law allowed homeowners to transfer the base year value from home to home, but only within their county or to a county with an intercountry ordinance – of which there were 10 when Prop. 19 passed. Additionally, homeowners previously had been limited to one lifetime transfer when 55 or older, with the option of a second transfer only if they became permanently and severely disabled. Under Prop. 19, homeowners can now make a base year value transfer in any California county, and they may make up to three transfers during their lifetime. Finally, under the old law, a homeowner could only transfer the assessed value to a home of equal or lesser value. Prop. 19 allows base year value transfers for property of any value, with the amount above “equal or lesser value” added to the transferred value. As a result, at least as to base year value transfers, homeowners are better off now than before Prop. 19.

Intergenerational Exclusions and Proposition 19

Under the parent-child (and grandparent-grandchild) exclusion, a taxpayer may transfer the assessed value of real property from one generation to the next. Consequently, such transfers are known as intergenerational transfers, and this exclusion has been called the intergenerational transfer exclusion.

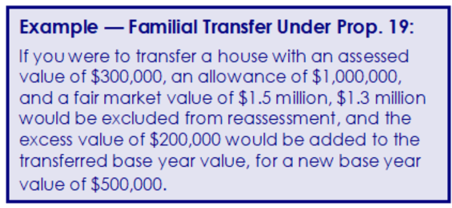

Pre-Prop. 19 law provided greater benefits when it came to familial transfers of real property. Under the old law, there was no base year value limit on parent-child transfers. Prop. 19, on the other hand, limits a parent-child (or grandparent-grandchild) transfer exclusion to the current base year value of the transferred principal residence plus $1,000,000. Under Prop. 19, the current fair market value in excess of the assessed value plus an allowance of $1,000,000 will be added to the transferred base year value.

Pre-Prop. 19 law provided greater benefits when it came to familial transfers of real property. Under the old law, there was no base year value limit on parent-child transfers. Prop. 19, on the other hand, limits a parent-child (or grandparent-grandchild) transfer exclusion to the current base year value of the transferred principal residence plus $1,000,000. Under Prop. 19, the current fair market value in excess of the assessed value plus an allowance of $1,000,000 will be added to the transferred base year value.

In addition, under Prop. 19, the transferred principal residence must become the principal residence of the child to avoid reassessment. This was not the case under prior law. Regarding other real property to transfer, prior law provided transferors a lifetime limit of $1,000,000 of base year value to transfer. Under Prop. 19, this benefit has been eliminated. This means real property transferred to children other than a principal residence – such as rental property, vacation property, or business property (such as a family business) – is subject to reassessment. Taxpayers should be aware of this change in law when estate planning or making transfers of property to their children or grandchildren.

It would require a constitutional amendment to regain the benefits lost from the parent-child transfer exclusion under Prop. 19. Introduced in May 2021, Assembly Constitutional Amendment 9 (Kiley) would have amended section 2.1 to Article XIII A to restore the prior parent-child exclusion benefits. However, this measure was never heard in policy committee.