You can also view this newsletter as a PDF.

Metrics on Human Capital Management Essential

for Successful Transition to Workforce of the Future

In recent years, California has seen a rapid shift in the way work is done and the types of jobs available. The COVID-19 pandemic has accelerated the transition to remote work, and traditionally in-person sectors such as commerce and manufacturing have become increasingly automated. Controller Yee wants to see this economic transition achieved in a just and inclusive manner, so no one is left behind — not the cashier whose job is being replaced by a touch screen, or the offshore oil worker whose rig is being decommissioned.

Controller Yee believes the most valuable asset of any company is its employees, which is why human capital management (HCM) must be at the forefront of corporate policy and governance. HCM includes recruiting, training, retaining, and compensating a company’s workforce, and investors view it as an essential aspect of a just transition. Within the last two years, Controller Yee sponsored Assembly Bill (AB) 1192 and AB 2095, which would have required companies with 1,000 or more California employees to report annually on HCM metrics.

Investor Engagement Catalyst for Change

Many large shareholders, such as the two major California pension funds on whose boards Controller Yee serves — the California Public Employees’ Retirement System (CalPERS) and California State Teacher’s Retirement System (CalSTRS) — also share this view and consistently engage with corporations on the issue. Successful advocacy can help companies and investors avoid a shareholder proposal, saving both sides time and money and leading to more collaborative outcomes.

The 2022 proxy season saw a record number of votes calling for publicly traded companies to disclose environmental, social, and sustainable governance (ESG) shareholder resolutions. Over the past five years, the number of ESG resolutions has more than tripled, and the 2022 proxy season is not yet over. There has been a growing push from shareholders for companies to release specific HCM metrics including the cost of employing the workforce; employee turnover rates; workforce diversity; and board member demographics.

In August 2020, the U.S. Securities and Exchange Commission (SEC) responded to this push by amending Regulation S-K, which governs reporting requirements for SEC filings. These amendments require companies to disclose HCM metrics in their annual filings to the SEC, but they do not specify which metrics should be reported. Currently, companies exhibit varying levels of compliance, with some listing all of the metrics described above and more, while others list as few as needed to satisfy the rule. This ambiguity has led companies and investors to call on the SEC to clearly define the HCM metrics companies should disclose.

CalPERS and CalSTRS have sent letters in recent years explaining that investors want companies to publish standardized HCM metrics in their annual filings to increase transparency, and, ultimately, returns on investment (ROI). These letters highlight that investing in human capital correlates to higher ROI, increased workforce productivity, reduced turnover, improved customer satisfaction, and greater success at talent acquisition.

Metrics Inform Responses to Future Economic Disruptions

The COVID-19 pandemic has made this data more crucial, as large institutional investors seek information about companies’ pandemic response in terms of employee safety and telework strategies. Controller Yee believes mandating these metrics will equip shareholders with the tools to respond appropriately to future unexpected crises. Widespread economic disruptions can drastically affect how a company operates. Insights into how those changes affect a company’s workforce demographics, retention, and profitability will benefit investors and companies alike.

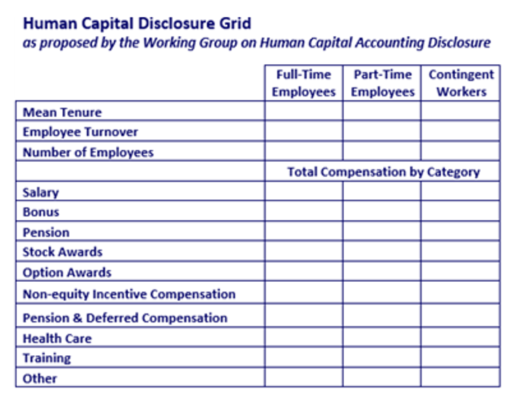

In considering the challenges of disclosure for companies and the SEC, the Working Group on Human Capital Accounting Disclosure reports that costs will be minimal, as calls for disclosure are centered on information companies currently collect for tax reporting purposes. The Working Group also devised a proposed grid for SEC adoption to mandate companies capture metrics including turnover, salary, pension and deferred compensation, health care, and training for full-time, part-time, and contingent workers.

In considering the challenges of disclosure for companies and the SEC, the Working Group on Human Capital Accounting Disclosure reports that costs will be minimal, as calls for disclosure are centered on information companies currently collect for tax reporting purposes. The Working Group also devised a proposed grid for SEC adoption to mandate companies capture metrics including turnover, salary, pension and deferred compensation, health care, and training for full-time, part-time, and contingent workers.

The global nonprofit Ceres views publishing HCM metrics as a critical component in a just and inclusive transition toward a green economic future. Its Roadmap to 2030 outlines goals for companies to achieve by 2020, 2025, and 2030, aimed at diversifying their workforce and preparing for factors such as automation, consumer preferences and demand, and the effects of climate change on certain industries. Ceres believes HCM intersects with human rights management and calls for HCM to be focused on protecting employees from these potentially adverse effects on the economy.

Controller Yee Hopeful Companies Will Invest in Their People

As chief fiscal officer of the world’s fifth-largest economy and a fiduciary of CalPERS and CalSTRS, Controller Yee understands the economy will continue to change rapidly over the coming years. Publishing standardized HCM metrics in companies’ annual SEC filings could add stability by allowing investors to track not only a company’s profitability, but also diversity, equity, and inclusion efforts, as well as their responses to crises. All of these factors affect the long-term success of companies in which the pension funds invest.

As she continues to push for federal action by the SEC, Controller Yee believes HCM is yet another issue on which California can take the lead. While her recent legislative proposals were not enacted, she remains hopeful for greater corporate responsibility to employees.

Investors and companies should not be alone in their calls for greater ESG governance and transparency. Public-facing data would allow consumers and job seekers to know how the companies they buy from and work for treat their most valuable asset — their people.

CDLAC Updates Bond Scoring to

Prioritize Affordable Housing Development

In July, the California Debt Limit Allocation Committee (CDLAC), on which Controller Yee serves, updated its regulations to manage the oversubscription of Private Activity Bonds (PABs).

In July, the California Debt Limit Allocation Committee (CDLAC), on which Controller Yee serves, updated its regulations to manage the oversubscription of Private Activity Bonds (PABs).

Oversubscription Drives Need for Reform

PABs are available to private entities developing projects that meet identified public goals. After a decade in which there were enough PABs to award to all applicants, the bonds have been competitive since 2020. The recent regulation changes mainly affect the allocation of PABs to affordable multi-family housing developments.

California’s needed investment in affordable housing has increased the use of the bonds for housing. The oversubscription of bonds allows CDLAC to ensure the state’s housing priorities are reflected in the scoring system. The CDLAC board has identified four areas that should be incentivized when awarding bonds and tax credits: unit production, affordability, tenant opportunity, and transit-oriented development.

Affordable multi-family developments that receive a PAB allocation also are eligible for federal 4-percent tax credits to subsidize the project. The awarded 4-percent tax credits total around $3 billion annually. Since 2020, the state has also made $500 million in state tax credits available to projects awarded PABs and 4-percent federal tax credits.

In total, around $3.5 billion of affordable housing subsidy is allocated through the CDLAC bond allocation process. The Tax Credit Allocation Committee (TCAC), another housing finance board on which Controller Yee serves, oversees the allocation of federal and state tax credits, although the CDLAC bond allocation process determines the majority of these awards.

New System Ranks Projects by Public Benefit

The scoring and ranking process is the main tool to incentivize the state’s housing priorities. This process has been adjusted to maximize the amount of affordable housing that is developed through CDLAC’s PAB allocations. The revised scoring tiebreaker introduces a public benefit efficiency measure to the process. Projects that provide the most public benefit per state dollar invested will be awarded bonds.

The public benefit efficiency measure first calculates the public benefit of each affordable housing project in terms of dollars. The factors included in the calculation include affordable units produced, depth of affordability, special populations served, community resources, transit proximity, and area walkability. These factors are aggregated for each project into a total public benefit value in dollars. The state’s investment is determined by adding the bond and state tax credit allocation from CDLAC and TCAC. Projects then are ranked by the ratio of the public benefit to the total state investment.

Oversight, Revisions, and More Change Needed

Oversight, Revisions, and More Change Needed

CDLAC staff have agreed to analyze awards under the new system to ensure the intended priorities are being recognized effectively. There is a risk of one priority being given outsized weight in scoring and dominates the others in the new system. Affordability and building in high resource areas appear to have been given primacy in the new system. The committee will monitor outcomes to unit production and environmental goals continue to be met. As housing needs and priorities change, the scoring system will need to be continually revised to ensure projects that best meet state needs are awarded bonds.

While the changes approved by CDLAC in July are a significant positive step, Controller Yee believes more needs to be done. In her view, the committee should develop an objective method for determining PAB allocations to regions across the state. CDLAC currently groups counties by housing-cost profile, rather than proximity, for purposes of “geographic region” allocations. To ensure California is building affordable housing in all areas of the state, Controller Yee believes regions should be based on geography and workforce needs.

A more comprehensive measure of the state-controlled subsidies that are provided to projects would ensure California maximizes the impact of these resources. Subsidy funds from the California Department of Housing and Community Development and California Housing Finance Agency should be included in the efficiency formula, since these resources are just as limited as PABs and tax credits. Controller Yee has long argued that creating a single competition for all of these funds would be the most efficient way to allocate all state-controlled affordable housing resources.

TCAC allocates an additional $2 billion in 9-percent federal tax credits annually through a separate competitive process. This competition has remained substantially the same over the last several years. Controller Yee believes TCAC regulations would benefit from incorporating a public benefit efficiency measure into the scoring as well. Currently, the 9-percent tax credit scoring has few efficiency incentives or controls. Due to the nature of federal tax law around affordable housing bonds and tax credits, a public benefit efficiency measure would be more impactful on the 9-percent tax credit competition than on the CDLAC PAB competition.

CDLAC’s work over the last few years has resulted in a better allocation process than existed prior to the oversubscription of bonds. However, as Controller Yee’s term comes to a close, significant work remains to be done. In the years ahead, CDLAC and TCAC can choose to build off of these changes, creating a lasting solution to the state’s pressing housing needs. Sliding back to business as usual would lessen the impact these funds can have on combating California’s affordable housing crisis.