You can also view this newsletter as a PDF.

Voter-approved Spending Limit Poses

New Challenges Amid Unprecedented Revenue Growth

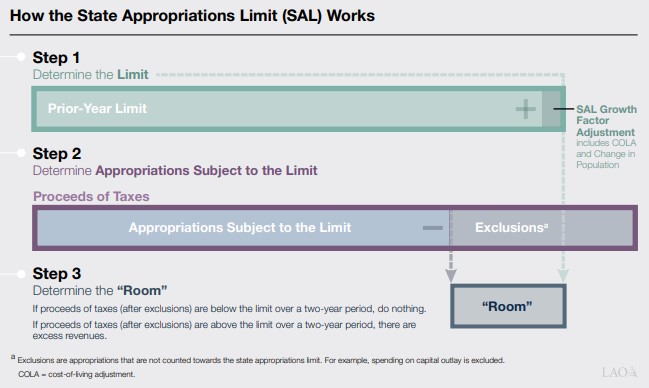

A term has been gaining prominence in state finance talk that may not be familiar to everyone: the “Gann Limit.” In 1979, California voters overwhelmingly approved Proposition 4, a state constitutional measure to limit state spending. Called the State Appropriations Limit (SAL) in the state’s constitution, the cap is colloquially referred to as the Gann Limit for Paul Gann, who pushed for the measure’s passage.

Prop. 4 added Article XIII B to the California Constitution, stating:

The total annual appropriations … shall not exceed the appropriations limit of the entity of government for the prior year adjusted for the change in the cost of living and the change in population, except as otherwise provided in this article.

In the event the state exceeded its spending limit, the provision required it return the “excess” to taxpayers the following year. However, Article XIII B was amended by Proposition 111 of 1990, which changed the population and cost-of-living standards in calculating permitted spending. According to the nonpartisan Legislative Analyst’s Office (LAO), the changes “created more room for state and local appropriations.”

Prop. 111 required that excess revenues be determined over a two-year period rather than a single year. The ballot measure also required that half of excess revenue be distributed to school programs, rather than tax refunds and rebates.

Some state spending falls outside the SAL, such as spending on infrastructure (capital outlay), debt service, local subventions, and emergency response.

The Current Dilemma

California now faces two major challenges relating to the SAL.

The SAL is adjusted based on two factors: the annual change in state population and the annual rate of change in cost of living, or inflation.

The state’s population is holding steady, and the rate of inflation over the past two years also was relatively flat—although it has increased substantially this year.

In contrast, state revenues now are growing faster than the percentage of “room” created by the annual SAL adjustment. According to the May Revision of the Governor's proposed budget, baseline General Fund revenues exceed the Governor's initial budget forecast by $54.6 billion. As a result, the state has hit its SAL-directed spending limit.

The second problem arises because the state is required to allocate much of its tax revenue by formula regardless of the appropriations limit. This creates a paradox when combined with a constitutionally imposed spending limit.

Proposition 98 of 1988 dictates that 38 percent of the state’s General Fund revenues must flow to education; Proposition 63 of 2004 mandates certain income tax revenues pay for behavioral health; and Proposition 2 of 2014 requires spending on reserves and debt.

The LAO reports that these obligations together mean the state is required to spend $1.60 for each dollar in unanticipated revenues at or above the SAL.

The practical implication is that these competing factors limit the Governor and Legislature from fully pursuing their top policy objectives, because excess revenues must either be given back to taxpayers, spent on education, or directed to SAL-excluded expenditures.

Additionally, spending on any programs not excluded from SAL—such as health care or child care—further restricts spending or investments in other program areas.

How Serious is the Problem?

The state is faced with a Catch-22 dilemma. On one hand, if state revenues continue to grow at a fast pace, spending restrictions triggered by SAL become much worse. On the other hand, if state revenues decline and the state experiences recessionary pressures, it likely will not have enough revenue to meet its existing funding requirements. The LAO describes the dilemma like this:

“…And Sets Up a Fiscal Cliff as Early as 2023-24. Although the unaddressed 2022-23 SAL requirement is relatively small, because the SAL is calculated over two years, the 2022-23 requirement must be considered alongside the state’s 2023-24 SAL position. Our estimates suggest the May Revision sets the state up for a significant budget problem as soon as next year. Specifically, under our estimates of the Governor’s revenue assumptions and spending proposals, the state would face an additional SAL requirement of over $20 billion in 2023-24, but have a surplus of only $1.6 billion in that year. This means that the state would have a budget problem of roughly $25 billion in next year’s budget process. Importantly, the state cannot ‘grow its way out’ of this kind of budget problem. As we have discussed previously, for each $1 in revenues the state collects above the limit, it must allocate about $1.60 in constitutional requirements. This means that if revenues are higher than the Governor’s budget anticipates, the state will be in an even worse fiscal position.”

Possible Solutions

The Governor and Legislature have several options:

- They can maintain the status quo and budget within the confines of the state constitution;

- They can consider options suggested by LAO to provide additional “room” under the SAL:

- Lowering taxes;

- Providing more subventions to local governments;

- Increasing spending on infrastructure;

- Spending more on emergencies; and

- Reducing non-Excluded Spending; or

- As done with Prop. 111, the Legislature can introduce a constitutional amendment to change the existing SAL formula and requirements.

Conclusion

Controller Yee finds it unfortunate that—in a rare time when California has ample resources to address critical issues such as climate change and homelessness—the state’s ability to strategically budget and prioritize on behalf of the public is severely hamstrung.

As California’s chief fiscal officer, she strongly recommends elected leaders look to balance the ability to prepare a meaningful budget with the principle of fiscal restraint voiced by the people when they voted overwhelmingly to approve the Gann Limit.

Controller Urges Investors, Government

to Recognize Value in Water

Investors have long focused on the risks of carbon emissions in their portfolios. Now they are actively lobbying corporations to lessen their reliance on fossil fuel corporations to preserve long-term value. Water scarcity and quality are additional risks faced by investors, as they grapple with understanding and quantifying its impact on the corporations in which they invest. However, unlike carbon emissions, which are somewhat easier to measure and manage, the public good nature of water makes it more complicated for investors, corporations, and government at all levels.

Although it does not always attract the attention it warrants in conversations about environmental, social, and governance (ESG) risk factors, Controller Yee believes water should be at the core of such work. After another year with a very dry winter, California—where two-thirds of the nation’s fruits and nuts and a third of its vegetables are gown—is again facing severe drought conditions. As challenging as this is for such a key industry, people are the ultimate stranded asset when it comes to water; more than two billion people lack access to safe, clean drinking water, including many in the U.S.

Controller Yee recognizes companies and investors have to play stronger stakeholder and leadership roles on water issues. The public pension fund boards on which she sits have both acknowledged the risk to long-term share value, since no company can operate without water. However, she believes we need to move beyond simply recognizing the importance of the issue and toward commitments and action at scale. Shifting the focus from individual companies to sectors and industries will help investors push for large-scale change in how water risk is managed.

Over the past two years, Controller Yee has served on the Valuing Water Finance Task Force convened by global nonprofit Ceres. The team studied this issue with a range of investors and climate scientists. This work has culminated in the report Global Assessment of Private Sector Water Impacts. The report examines five critical threats to global freshwater systems: groundwater depletion, metal contamination, plastic pollution, water diversion and transfer, and eutrophication–when runoff with excess nutrients leads to excessive plant growth and fish die-offs. The goal is to provide investors an understanding of these challenges across 12 key industries and outline a path for engagement.

As noted in the report, these issues are widespread and pose broader systemic risks to the global economy, as well as long-term financial threats to corporate shareholders such as pension funds. A 2021 Barclays research note warned that the consumer staple sector alone, including agriculture, food, and beverage companies, is facing a potential $200 billion impact from water scarcity risks—roughly three times higher than carbon-related risks. A 2020 CDP report based on data from nearly 3,000 companies warned of even larger business losses, potentially eclipsing $300 billion if water risks are not mitigated.

The Ceres report concludes it will be impossible to advance global water security without far stronger private sector leadership, both from companies and investors. Controller Yee considers partnerships with government at all levels to be crucial to the success of this work. Weak or nonexistent policies and regulations governing water use and quality have led to less accountability for the private sector. Water is undervalued, and the global economy continues to treat it as an infinite resource lacking monetary value.

If water is misvalued, it is bound to be mismanaged. Vulnerable communities around the globe are sure to suffer the greatest impacts from water diversion, pollution, and degradation of water quality.

At least half of public companies listed in each of the four major stock indices fall within industries with medium to high water risk. Ceres has launched an initiative aimed at forming a partnership of investors to collectively engage these corporations. Ceres’ Investor Water Hub already includes over 150 institutional investors with $40 trillion assets under management. The goal is to recruit 30 investors to publicly endorse and agree to communicate the Valuing Water Corporate Expectations through company engagements. These include corporate disclosure on how a company manages water with an emphasis on conservation, pollution, ecosystem protection, board oversight, and corporate lobbying.

Controller Yee urges all major stakeholders—corporations, investors, and government—to work together to ensure we recognize the value in water and protect this most critical finite resource for a secure long-term future.