You can also view this newsletter as a PDF.

What You Need to Know This Tax Season:

From Tax Prep Assistance to Key Changes in Law

The federal Internal Revenue Service (IRS) and the California Franchise Tax Board (FTB) are accepting and processing 2021 tax returns. For faster refunds and increased accuracy, taxpayers are urged to file electronically and include direct deposit information for refunds. The filing deadline for most taxpayers is Monday, April 18, 2022. For this filing season, FTB expects to process 20 million personal income tax returns, and the IRS expects more than 150 million individual income tax returns.

As of February 4, the IRS had issued 4.3 million refunds worth $9.5 billion. Last year, 95 percent of returns filed with the FTB were submitted electronically. The state issued more than 14.7 million refunds, totaling more than $15.4 billion.

Beware of Scams

Taxpayers are encouraged to stay vigilant and protect themselves from scams. Scammers often prey on taxpayers by impersonating IRS or FTB employees. They may attempt to trick taxpayers into sending money not owed or providing personal information that could be used to file fraudulent returns and steal refunds. If you receive a letter from FTB or the IRS that appears suspicious, contact FTB at (800) 852-5711 or IRS at (800) 829-1040. Concerned taxpayers also may check the FTB Letters page or Understanding Your IRS Notice or Letter.

Earned Income Tax Credit and Young Child Tax Credit

People who earned less than $30,000 in 2021 may qualify for the California Earned Income Tax Credit (CalEITC). Those who qualify for CalEITC and have a child under age six may be eligible to claim the Young Child Tax Credit (YCTC), in an amount up to $1,000. Those earning less than $57,414 also may qualify for the federal EITC. Between CalEITC, YCTC, and the federal EITC, a family can receive up to $10,888. CalEITC and YCTC are claimed by filing a state tax return with FTB, while the federal EITC is claimed on a federal return filed with the IRS.

The main challenge in getting these credits to eligible people is getting those who are not required to file tax returns due to low income to file. Taxpayers may estimate their potential credits by using FTB’s recently designed credit calculator.

Free Tax Preparation: CalFile and VITA

Free Tax Preparation: CalFile and VITA

FTB offers free electronic filing for state tax returns through CalFile, an easy-to-use tool available to more than 6.5 million taxpayers. CalFile allows taxpayers to e-file directly with FTB and provides instant confirmation when the return is received. CalFile accepts returns with CalEITC and the YCTC, along with any CalEITC filers with an Individual Taxpayer Identification Number (ITIN). The income limit for using CalFile is $424,581.

Income-eligible Californians who need help filing a personal income tax return can access the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. VITA is a free service available to individuals who earned $58,000 or less, those with limited English proficiency, and people with disabilities.

The TCE program offers free tax help, particularly for those who are 60 years of age and older. The program specializes in questions about pensions and retirement-related issues unique to seniors. In addition, taxpayers can file their federal tax return online for free using the IRS Free File program.

FTB Customer Service

FTB Customer Service

FTB’s communication channels provide services and information to help taxpayers file accurate and timely tax returns and pay the proper amount owed. These channels include a Customer Service Line at (800) 852-5711, Tax Practitioner Hotline, Authenticated Chats, and assistance at Field Offices.

FTB also offers many online tools, including checking the status of a tax refund with Where’s My Refund and online access to tax account information with MyFTB account.

New for this year, FTB has implemented a feature that will allow tax professionals and individual taxpayers the ability to register for their MyFTB account in “real time.” When registering for a new MyFTB account, tax professionals and individual taxpayers will have the option of providing additional information that FTB will use to validate against a third-party service.

If the registrant can be validated, then the registrant will not have to wait for a Personal Identification Number (PIN) to be mailed. Rather the registrant will receive an email to activate their account within a few minutes.

Health Coverage Mandate

Californians who did not have qualifying health insurance throughout the year are subject to a penalty of $800 or more when they file their state tax returns. The penalty for a dependent child is half that of an adult; a family of four could face a penalty of $2,400 or more. If you had health coverage in 2021, check the “Full-year health care coverage,” box 92, on your state tax return to avoid penalties.

You can get health coverage and financial help at CoveredCA.com. It is crucial to get health coverage to avoid penalties when filing your tax return next year. For information, visit ftb.ca.gov/healthmandate.

Tax Treatment of COVID Relief for Individuals

FTB—Golden State Stimulus

During 2021, California provided Golden State Stimulus payments to qualifying individuals and families. For Golden State Stimulus I, eligibility was based on filing a 2020 tax return claiming the CalEITC, or filing a 2020 tax return with an ITIN. For Golden State Stimulus II, eligibility was based on filing a 2020 tax return with earned income from $1 to $75,000.

Families and individuals may have qualified for both payments. Golden State Stimulus payments are not subject to California income tax.

Federal Economic Impact Payments and Recovery Rebate Credit

The American Rescue Plan Act of 2021 (ARPA) authorized a third round of federal Economic Impact Payments as an advance payment of the tax year 2021 Recovery Rebate Credit. The IRS has issued all first, second, and third Economic Impact Payments. People who are missing the third stimulus payment or received less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2021 federal income tax return.

Advance Child Tax Credit Payments

Under the ARPA, the IRS made monthly Advance Child Tax Credit payments. The monthly payments, issued from July through December, constituted up to half of the available 2021 Child Tax Credit. Eligible taxpayers may claim the balance of the federal Child Tax Credit with the filing of their 2021 federal tax return.

Income Exclusion for Rent Forgiveness

For taxable years beginning on or after January 1, 2020, and before January 1, 2025, gross income shall not include a tenant’s rent liability that is forgiven by a landlord or rent forgiveness provided through funds grantees received as a direct allocation from the Secretary of the Treasury based on the federal CAA.

Tax Treatment of COVID Relief for Businesses

California Microbusiness COVID-19 Relief Grant

For taxable years beginning on or after January 1, 2020, and before January 1, 2023, California law allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the California Microbusiness COVID-19 Relief Program administered by the Office of Small Business Advocate (CalOSBA). For more information, see Revenue and Taxation Code (R&TC) Section 17158.1 and 24311.

California Venues Grant

California Venues Grant

For taxable years beginning on or after September 1, 2020, and before January 1, 2030, California law allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the California Venues Grant Program that is administered by CalOSBA. The program was designed to help independent live event venues affected by the pandemic remain in business. For more information, see R&TC Section 17158 and 24312.

Shuttered Venue Operator Grants

The federal Consolidated Appropriations Act of 2021 (CAA), enacted on December 27, 2020, allows an exclusion from gross income for grants received by shuttered venue operators. With the enactment of Senate Bill 113 (Chapter 3, Statutes of 2022), California conforms to this federal provision for taxable years beginning on or after January 1, 2019. SB 113 also adopted, except as provided, the provisions of the federal CAA, prohibiting any reduction in tax deductions, reductions in tax attributes, and denials of basis adjustments based on the exclusion from gross income, as provided.

Restaurant Revitalization Grants

Restaurant Revitalization Grants

The ARPA allows an exclusion from gross income for restaurant revitalization grants awarded to eligible entities that are used for allowable expenses for the covered period. SB 113, in modified conformity with federal law, for taxable years beginning on or after January 1, 2020, excludes from gross income any amount received in the form of a federal restaurant revitalization grant. SB 113 also adopts, except as provided, the provisions of the ARPA prohibiting any reduction in tax deductions, reductions in tax attributes, and denials of basis adjustments based on the exclusion from gross income.

Small Business COVID-19 Relief Grant Program

For taxable years beginning on or after January 1, 2020, and before January 1, 2030, California allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the COVID-19 Relief Grant under Executive Order No. E 20/21-182 and the California Small Business COVID-19 Relief Grant Program established by Section 12100.83 of the Government Code.

For taxable years beginning on or after January 1, 2020, and before January 1, 2030, California allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the COVID-19 Relief Grant under Executive Order No. E 20/21-182 and the California Small Business COVID-19 Relief Grant Program established by Section 12100.83 of the Government Code.

Paycheck Protection Program Loan Forgiveness

For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for covered loan amounts forgiven under the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act; Paycheck Protection Program (PPP) and Health Care Enhancement Act; Paycheck Protection Program Flexibility Act of 2020; or the CAA.

However, the Paycheck Protection Program Extension Act extends the covered period of the PPP to June 30, 2021. California law does not conform to this extension and does not allow an exclusion from gross income for PPP loans forgiven due to the extended covered period after March 31, 2021 to June 30, 2021.

Also, the ARPA expands PPP eligibility to include “additional covered nonprofit entities,” which includes certain Code 501(c) nonprofit organizations, Internet-only news publishers, and Internet-only periodical publishers. California law does not conform to this expansion of PPP eligibility.

The CAA allows deductions for eligible expenses paid for with covered loan amounts. California law conforms to this federal provision, with modifications. For California purposes, these deductions do not apply to an ineligible entity. An “ineligible entity” is a tax filer that either is a publicly-traded company or does not meet the 25-percent reduction from gross receipts requirements under Section 311 of Division N of the CAA.

Revenue Procedure 2021-20 allows taxpayers to make an election to report the eligible expense deductions related to a PPP loan on a timely filed original 2021 tax return including extensions. If a taxpayer makes an election for federal purposes, California will follow the federal treatment for California tax purposes.

Advance Grant Amount

For taxable years beginning on or after January 1, 2019, California law conforms to the federal law regarding the treatment for an emergency Economic Injury Disaster Loan (EIDL) grant under the federal CARES Act or a targeted EIDL advance under the CAA.

Other Loan Forgiveness

For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for forgiveness of indebtedness as described in Section 1109(d)(2)(D) of the federal CARES Act and section 278, Division N of the federal CAA. The CAA allows deductions for eligible expenses paid for with covered loan amounts. California law conforms to this federal provision, with modifications. For California purposes, these deductions generally do not apply to an ineligible entity as defined under “Paycheck Protection Program Loan Forgiveness.”

Reporting Requirements

For taxable years beginning on or after January 1, 2021, taxpayers should file form FTB 4197, Information on Expenditure Items, with FTB if they benefited from the exclusion from gross income for PPP loan forgiveness, other loan forgiveness, or the EIDL advance grant and related eligible expense deductions under the federal CARES Act, PPP, Paycheck Protection Program Flexibility Act of 2020, or the CAA.

Additional Changes to CA Tax Law

Gross Income Exclusion for Bruce’s Beach

Effective September 30, 2021, California law allows an exclusion from gross income for the first-time sale in the taxable year in which the land within Manhattan State Beach, known as “Peck’s Manhattan Beach Tract Block 5” and commonly referred to as “Bruce’s Beach,” is sold, transferred, or encumbered. A recipient’s gross income does not include the following:

- Any sale, transfer, or encumbrance of Bruce’s Beach; or

- Any gain, income, or proceeds received that is directly derived from the sale, transfer, or encumbrance of Bruce’s Beach.

Moving Expense Deduction

Moving Expense Deduction

For taxable years beginning on or after January 1, 2021, taxpayers should file California form FTB 3913, Moving Expense Deduction, to claim moving expense deductions. The completed form FTB 3913 should be attached to Form 540, California Resident Income Tax Return.

Elective Tax for Pass-Through Entities and Credit for Owners

For taxable years beginning on or after January 1, 2021, and before January 1, 2026, California law allows an entity taxed as a partnership or an “S” corporation to annually elect to pay tax at a rate of 9.3 percent based on its qualified net income. The election must be made on an original, timely filed return and is irrevocable for the taxable year.

The law allows a credit against the personal income tax to a taxpayer, other than a partnership, that is a partner, shareholder, or member of a qualified entity that elects to pay the elective tax, in an amount equal to 9.3 percent of the partner, shareholder, or member’s pro rata share or distributive share of qualified net income subject to the election made by the qualified entity.

SB 113 expanded elective tax for pass-through entities and credit for owners in two ways: 1) allows disregarded Limited Liability Companies to participate in the elective tax; and 2) it allows the personal income tax credit to reduce tax below the tentative minimum tax.

Homeless Hiring Tax Credit

For taxable years beginning on or after January 1, 2022, and before January 1, 2027, a Homeless Hiring Tax Credit will be available to a qualified taxpayer who hires individuals who are, or recently were, homeless. The amount of the tax credit will be based on the number of hours the employee works in the taxable year.

Employers must obtain a certification of the individual’s homeless status from an organization that works with the homeless and must receive a tentative credit reservation for that employee. Any credits not used in the taxable year may be carried forward up to three years.

Controller Yee Seeks to Maximize

Public Benefit of Private Activity Bonds

The federal government provides each state an annual allocation of tax-exempt bond authority for development of private enterprises that serve specified public benefits. These are known as private activity bonds. In 2022, California has a private activity bond pool of $4.3 billion.

The federal government provides each state an annual allocation of tax-exempt bond authority for development of private enterprises that serve specified public benefits. These are known as private activity bonds. In 2022, California has a private activity bond pool of $4.3 billion.

The California Debt Limit Allocation Committee (CDLAC) administers the allocation of private activity bonds to bond issuers for qualified projects across the state. Controller Yee is one of three voting members of CDLAC, along with the State Treasurer and the Director of Finance.

Projects eligible to use the bonds allocated by CDLAC include affordable rental housing projects, loans or tax credits for first-time homebuyers, solid waste and recycling facilities, transportation projects, and industrial development projects.

Private activity bonds derive their value from the tax exemption on the interest earned by bondholders. Bondholders require a lower interest rate on these bonds since the interest income is not taxable. The savings gained by average projects is approximately one percent per year over the life of the bonds. Private activity bonds are generally outstanding for 10 to 20 years.

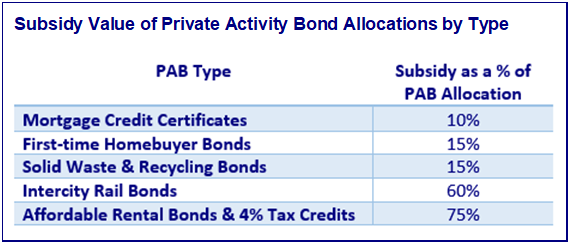

In short, the total base subsidy of private activity bonds is around one percent multiplied by 15 years, or 15 percent of the bond allocation. This amount can differ, depending on the level of market interest rates, the duration of the bond, and the creditworthiness of the project.

The federal government offers additional financial incentives for specific types of projects financed with private activity bonds. Mortgage credit certificates, which are federal tax credits for first-time homebuyers, also can be offered using private activity bond volume cap. Allocations to mortgage credit certificates provide a subsidy of around 10 percent of the bond allocation.

Intercity high-speed rail projects receive a four-times multiplier to the allocated bond amount, meaning each dollar in bond allocation allows for $4 in tax-exempt bond issuance. This increases the subsidy on intercity high-speed rail bonds to around 60 percent of the allocation.

The largest additional federal subsidy is available to affordable rental housing projects. Federal four-percent low-income housing tax credits are available to affordable rental housing projects that are funded with private activity bonds. The four-percent tax credits generally provide 25 to 40 percent of the equity needed to fund a project. This adds significant resources to complete these projects, bringing the total federal subsidy to 75 percent of the bond allocation.

The largest additional federal subsidy is available to affordable rental housing projects. Federal four-percent low-income housing tax credits are available to affordable rental housing projects that are funded with private activity bonds. The four-percent tax credits generally provide 25 to 40 percent of the equity needed to fund a project. This adds significant resources to complete these projects, bringing the total federal subsidy to 75 percent of the bond allocation.

Between 2007 and 2018, California’s private activity bonds were not fully allocated. However, since 2019, California’s private activity bonds have become oversubscribed. In this competitive environment, Controller Yee believes CDLAC should allocate the limited amount of private activity bonds in an efficient manner. Maximizing the federal subsidy leveraged through the private activity bonds is a clear path to maximizing the public benefit produced through the program.

The state manages programs funded with more flexibility to assist with the financing of housing and infrastructure projects. Many projects layer state funding along with private activity bonds. Several affordable rental housing projects have received funding commitments from the state but are unable to move forward without private activity bond and tax credit allocations. The state attempted to remedy this issue by allocating $1.75 billion in the Fiscal Year 2021-22 budget to fund these projects without the need for private activity bonds and four-percent tax credits through the California Housing Accelerator.

The Governor’s FY 2022-23 budget proposal includes an additional $200 million for this program. This amount is on top of tens of billions of dollars allocated to housing, infrastructure, and environmental programs pursuant to the last two state budgets.

In January, the CDLAC board adopted a 2022 allocation plan that allocates $510 million to the exempt facilities pool, $90 million to the single-family housing pool, and the remaining $3.7 billion to the affordable rental housing pool. The $600 million not allocated to affordable rental housing is not eligible for the four-percent tax credits, reducing the federal subsidy received by California projects by $360 million.

Controller Yee believes allocating the entirety of the state’s private activity bonds to affordable rental housing would allow the state to redirect a portion of the funds now budgeted for affordable housing to infrastructure and environmental programs. This would grow overall funding available by $360 million. Growing the pie of federal subsidies allows for California to better meet the needs of all of its residents.