You can also view this newsletter as a PDF.

Tax Filing Holds Potential to Unburden Struggling

Californians and Lift Businesses, Communities

As California works to confront a pandemic-induced recession, key tax relief measures stand to help millions, yet getting the people most in need to claim these benefits remains a daunting challenge.

As California works to confront a pandemic-induced recession, key tax relief measures stand to help millions, yet getting the people most in need to claim these benefits remains a daunting challenge.

The federal earned income tax credit (EITC) was signed into law in 1975 and later expanded by then-President Ronald Reagan who called it “the best anti-poverty, the best pro-family, the best job creation measure to come out of Congress.”

The EITC is a refundable credit available to people who work but earn a limited income. While many credits only can be used to offset a tax liability, a refundable credit is one which is paid out to the filer even if no tax liability is due. For tax year 2020, the federal EITC can be worth up to $538 for an individual with no dependents, and up to $6,660 for a married couple with three qualifying children.

California launched its own earned income tax credit, CalEITC, for tax year 2015. The program was expanded in 2017 to reach the self-employed and more working parents, and the income limit has since been raised to $30,000. Because federal EITC income limits are higher, those who qualify for the federal EITC are likely to qualify for CalEITC. For tax year 2020, CalEITC can be worth up to $243 for an individual with no dependents, and up to $3,027 for a married couple with three or more qualifying children.

In tax year 2019, California added the refundable Young Child Tax Credit (YCTC) to give low- to moderate-income parents of school-aged children additional assistance in the amount of $1,000 per filer. A family with three or more children that qualifies for EITC, CalEITC, and YCTC has the potential to get a refund of more than $10,000.

When California launched CalEITC, the Franchise Tax Board (FTB) and community partners devoted a great deal of resources for outreach to people who were likely to benefit and less likely to file. However, a January 2020 California Policy Lab report showed raising awareness about tax credits was not enough to get low-income households to file.

A major factor is that many of the people tax credits are created to help do not meet income thresholds that require them to file; and many come from communities that are hesitant to interact with government. People are not required to file a personal income tax (PIT) return if their income is lower than the standard federal deduction for their age and filing status. For 2020, that ranges from $12,400 for a single person under the age of 65 to $27,400 for a married couple aged 65 or over filing jointly—exactly the people for whom EITC is designed.

There is even more on the line for tax year 2020, as three rounds of federal stimulus payments were sent out based on previous tax filings. People who were eligible but did not receive one or more of these payments can recoup them as a credit on their 2020 PIT return. The latest research from California Policy Lab indicates 2.2 million Californians could miss out on $5.7 billion in stimulus payments by not filing—funds that would benefit individuals, families, and the communities in which those dollars would have been spent.

California also has launched the Golden State Stimulus program to put payments of $600 or $1,200 in the hands of low-income Californians and people left out of federal stimulus efforts, including those who file taxes using an Individual Taxpayer Identification Number. Income-eligible Californians also must file a state PIT return to claim this payment.

Researchers suggest Congress should allocate funding to state human services agencies for outreach to those in the “stimulus gap,” since many are enrolled in state safety net programs. Short of such direction and funding, outreach must be taken up by trusted messengers—local leaders and community organizations who are known and respected by members of underserved communities.

“It is up to each of us to reach out to our friends and neighbors and let them know filing through the Franchise Tax Board is safe, easy, and could benefit them greatly,” said Controller Yee, California’s chief fiscal officer and chair of FTB. “These funds left on the table represent meals that are not on the table. They are funds that could be going to local small businesses and keeping families from making impossible choices between food, medicine, and utilities.”

Controller Yee encourages every organization serving low- to moderate-income Californians to conduct outreach to encourage community members to promptly file a PIT return on their 2020 income, even if they are not required to. Those with bank accounts are urged to provide direct deposit information when filing to help them get a refund faster and have the information on record for any future economic stimulus efforts.

Controller Yee encourages every organization serving low- to moderate-income Californians to conduct outreach to encourage community members to promptly file a PIT return on their 2020 income, even if they are not required to. Those with bank accounts are urged to provide direct deposit information when filing to help them get a refund faster and have the information on record for any future economic stimulus efforts.

The COVID-19 pandemic has further complicated statewide outreach efforts by limiting the number of in-person Volunteer Income Tax Assistance sites traditionally offered. However, help is available, and millions of California are eligible to file online free of charge through CalFile.

A California resident can claim CalEITC going back four years by filing a state PIT return now for those tax years in which they were eligible. If someone filed a return in those four years and was eligible but did not claim CalEITC, they can file an amended return. The YCTC also can be claimed back to tax year 2019 by filing or amending a state PIT return.

Controller Yee added, “All told, four years of CalEITC could be a life-changing amount of money for a family surviving on the margins who has never filed taxes.”

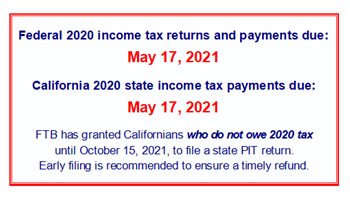

April traditionally is “Tax Month,” with April 15 the deadline to file and pay state and federal income taxes. For the second consecutive year, the Internal Revenue Service has extended the deadline to May 17, and California has followed suit. FTB has taken the additional step of granting an automatic extension of the deadline to file state PIT taxes to October 15. Those who owe state taxes still must pay by May 17. Those who do not owe are encouraged to file as early as possible to receive any refundable credits for which they are eligible.

Controller Yee Highlights Steps Needed

for Equitable Housing Policy

April is National Fair Housing Month—a celebration of the progress made toward this ideal, and a reminder of the work left to do to ensure equitable housing access for all.

April is National Fair Housing Month—a celebration of the progress made toward this ideal, and a reminder of the work left to do to ensure equitable housing access for all.

California holds a unique place in fair housing history, both in adopting discriminatory practices and in creating tools to overcome them. In 1916, Berkeley was the first jurisdiction in the nation to create exclusive single-family zoning, preventing poorer residents—often in communities of color—from living in many areas of the city. In 1963, California also created the model for the federal Fair Housing Act with passage of the Rumford Fair Housing Act by the state legislature. This measure prohibited housing discrimination based on ethnicity, religion, sex, marital status, physical handicap, or familial status. The Rumford Act started a conversation on housing discrimination that continues to this day.

Controller Yee believes California must continue to lead in solving inequities in the housing market, which are a driver of larger economic inequality. She is hopeful California will build on the Affirmatively Furthering Fair Housing regulation that was issued in 2015 under then-President Barack Obama and terminated in 2020. Currently, most state programs focus on making wealthier areas more accessible to all residents. Yee envisions a process that ensures existing lower-income neighborhoods are not left behind. Investment in place-based affordable housing development can reduce displacement of existing residents and help build stronger communities.

A coordinated strategy is needed to progress toward equitable housing policies. California would need to do more than just ban explicitly discriminatory practices; the state would need to incentivize housing development and opportunity that drives more equitable outcomes.

Several ideas have been proposed over the last few years to provide housing opportunities to more Californians. Housing California and the California Housing Partnership have aggregated many of these ideas in a ten-year plan for addressing the state’s housing crisis called Roadmap Home 2030. Controller Yee strongly believes the following proposals have the greatest potential to positively affect an equitable housing policy framework.

Zoning reform that eliminates exclusionary

single-family zoning in resource-rich communities

Several communities have used exclusionary zoning practices in the name of “preserving neighborhood character.” Allowing more types of housing—including duplexes, fourplexes, and apartment buildings—creates more integrated communities. Studies have shown that children raised in high-resource areas have significantly better outcomes in terms of education, health, and lifetime income. Several cities across the state—led by Sacramento, Berkeley, and South San Francisco—are moving to end single-family zoning practices. A statewide ban on exclusionary single-family zoning would be a major step toward addressing housing discrimination.

Holding local jurisdictions accountable for meeting housing development goals at all income levels

Enforcement of existing laws that require cities to zone for and allow the building of housing available to all income levels would prevent local jurisdictions from barring the integration of communities by limiting needed affordable housing development.

Creating a streamlined process for California Environmental Quality Act (CEQA) approvals for affordable housing developments

Opponents to the development of affordable housing often misuse CEQA to prevent or delay needed housing development for reasons unrelated to the environment. The state could create a streamlined process to reduce the time and cost to build housing projects affordable to low-income households.

Supporting state down payment assistance to promote racial equity

California currently offers down payment assistance programs for low- and moderate-income first-time homebuyers through the California Housing Finance Agency MyHome program and the Department of Housing and Community Development CalHome program. These programs could take a more targeted approach focused on historically disadvantaged communities to mitigate past discrimination and strengthen underserved communities. The ability to build wealth through homeownership has been out of reach for many communities of color as a direct result of past discriminatory practices. Targeted down payment assistance programs in conjunction with enforcement of existing fair housing laws is an important step toward addressing this history of inequality.

California has been at the leading edge of both discriminatory and anti-discriminatory housing policies in decades past. This National Fair Housing Month, Controller Yee sees opportunity for California to lead once again—at making quality, affordable housing accessible to all.