You can also view this newsletter as a PDF.

CalSavers Expanding Opportunity for

Retirement Security Amid Pandemic Uncertainty

Throughout the COVID-19 pandemic, Controller Yee has remained focused on the economic uncertainty faced by Californians: How do we build a better and more just economy? What can government do to make a difference for individuals?

The CalSavers Retirement Savings Program (CalSavers), of which Controller Yee is a board member, can potentially be a significant aspect for workers as attention is focused nationally and in California on rebuilding the economy. This program, launched statewide in 2019, seeks to make it easy for millions of California workers to save for retirement through payroll deductions. Despite the challenges of 2020, nearly 250,000 people enrolled.

CalSavers gives Californians access to a voluntary, low-cost, portable retirement savings program with professionally managed investments. It is a payroll deduction program through which a portion of a participant’s pay is deposited into an Individual Retirement Account (IRA) to be accessed in retirement. California law requires all employers who do not offer their own retirement savings plans to register for CalSavers. Eligible employees will be enrolled in the program automatically, but they can opt out at any time.

The CalSavers team has been reaching out to employers across the state to help them understand if they are required to register, and to explain their role in onboarding employees and setting up payroll deductions. When the pandemic hit, CalSavers quickly pivoted to online outreach. CalSavers team members presented at more than 210 local and statewide events in 2020, including 128 employer webinars hosted by CalSavers.

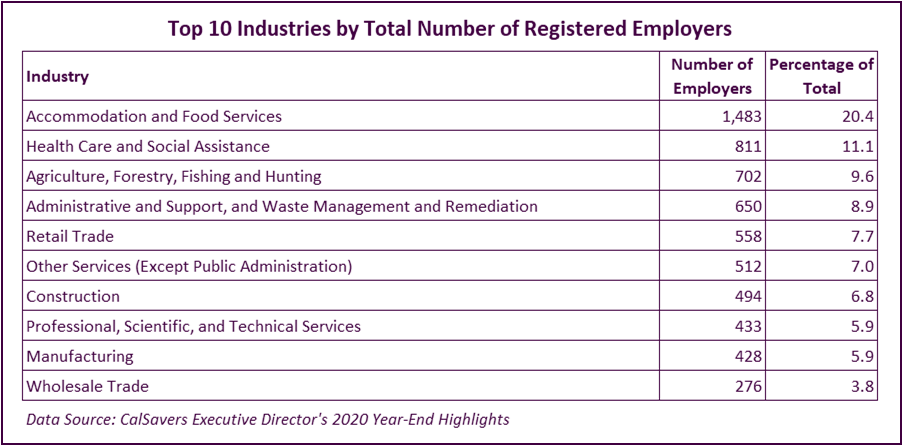

In order to help employers in an extremely challenging year, the CalSavers Board extended the deadline for large employers (those with more than 100 employees) to register for CalSavers by three months to September 30, 2020. By the end of the year, 7,278 employers across all 58 counties were registered. The next wave of employers required to register are those with 50 or more employees, and the deadline for them is June 30, 2021.

Once an employer begins participation, five percent of gross wages for employees who do not opt out are deposited into a CalSavers IRA. That amount automatically increases by one percent per year until capping at eight percent. Contributions will default into professionally managed target-date funds where asset allocations are based on age, automatically shifting to more conservative investments as an employee nears retirement age. Participants also can choose to contribute at a different rate, and to direct their contributions to other types of mutual funds instead.

Among those mutual fund choices is an option that considers environmental, social, and governance (ESG) factors. The CalSavers Sustainable Balanced Fund invests in global companies that demonstrate sustainable business practices and issuers of U.S. investment-grade securities that satisfy certain ESG criteria. Controller Yee was integral to ensuring an ESG option be available to CalSavers participants who want to make socially conscious investments. She also has been actively engaged in climate change investment policy as a board member of California Public Employees’ Retirement System and California State Teachers’ Retirement System.

CalSavers is the first state-administered retirement savings program for private sector workers to provide an ESG investment option.

According to AARP, workers with a payroll deduction savings option are 15 times more likely to be on a path to retirement income security. Those with automatic enrollment are 20 times more likely. By facilitating retirement contributions through payroll deductions, CalSavers will make a huge difference in retirement savings for participants. Participants also take their IRAs with them when they change jobs and can manage them any time by phone, website, or mobile app.

In these challenging times, CalSavers can ensure all Californians have access to simple and cost-effective retirement savings options.

Critical Focus Needed on Watershed Recovery

in Wake of Climate-fueled Wildfires

Climate change remains an existential threat affecting every Californian – from rapid sea-level rise threatening coastal and other regions, to raging wildfires that have decimated entire communities, to an overreliance on plastics compromising the health of our oceans. Climate and its affects are challenging society and the body politic.

Climate change remains an existential threat affecting every Californian – from rapid sea-level rise threatening coastal and other regions, to raging wildfires that have decimated entire communities, to an overreliance on plastics compromising the health of our oceans. Climate and its affects are challenging society and the body politic.

In the last century, a great deal of angst surrounded the issue of infrastructure development: Could we afford it? Could we afford not to make the investment? This century’s climate challenge is equally complex and raises similar questions. At the heart of this debate is how to, in the stewardship of California’s natural working lands, best make use of limited financial and human resources in the interest of public health and the health of the planet.

California’s watersheds are an important yet rarely discussed part of that working landscape, and they are facing concerning challenges of their own. Watersheds support regional ecosystems, as well as California’s water supply system. The historic fires of 2020 triggered significant degradation of these critical features.

California’s fire-scarred landscapes bring to mind two immediate challenges, beyond the obvious need for rebuilding affected communities: namely, revegetating the landscape and stabilizing the land to minimize debris flow and allow the land to heal. It is widely recognized that restoring the forests and vegetation is an imperative, even as it is understood it takes years for a watershed to regain much of its ecosystem function. With over four million acres affected by wildfire in 2020 alone, this is a daunting prospect.

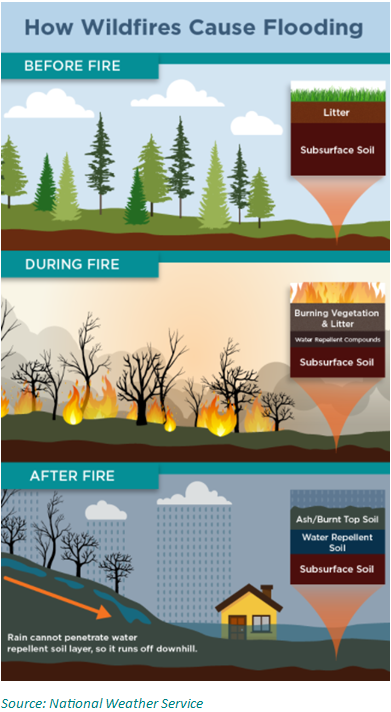

During this stage of California’s hydrologic cycle, precipitation is generally welcomed. Rain fills reservoirs, replenishes groundwater basins, and provides needed soil moisture. Intense rain events also can create a phenomenon known as “debris flow.” According to the U.S. Geological Survey, debris flows are fast-moving landslides that often strike without warning and are not uncommon after severe fire events. In January 2018, dramatic flows devastated the coastal community of Montecito in the aftermath of the Thomas Fire. Twenty-three lives were lost, more than 100 homes destroyed, and the region’s major thoroughfare – U.S. Highway 101 – shut down for almost two weeks. Experts warn similar events can be expected throughout the fire-scarred regions of California after the historic fire season the state just experienced.

Debris flows have proven they can decimate whole communities quickly. They also can dramatically change an ecosystem and the species – aquatic and terrestrial – that call the watershed home. In addition to affecting streams, creeks, and rivers, these flows can affect the capacity of the state’s reservoirs and related infrastructure. Sedimentation can dramatically change the scope and health of the ecosystem, further handicapping opportunities for plant and animal species to reestablish themselves.

So what can be done to protect and restore California’s watersheds? While the pandemic-induced recession may limit opportunities for immediate action, California leaders must recognize the role watersheds play in water supply and quality and assess the long-term investments needed to restore the affected landscape. From the Tuolumne River watershed (Hetch Hetchy Reservoir), to the watersheds attached to the Sacramento River (Shasta and Oroville), to lesser-known local watersheds, consideration must be given to how best to target investments to steward these ecosystems – for California’s water supply and for the critical function they play in providing resiliency in the face of climate change.