You can also view this newsletter as a PDF.

Controller Yee Renews Call for Streamlined

Housing Finance System to Spur Home Building

It is widely known that California is in a decades-long housing crisis. Controller Yee believes state government must act decisively to address the shortfall of affordable housing units.

A November 2020 report by the California State Auditor (CSA) reconfirms Controller Yee’s contention that California suffers from a fragmented structure that requires developers of affordable housing to obtain funding separately from multiple state subsidy programs, each with its own requirements, scoring criteria, and timelines.

CSA highlights how a lack of alignment is bogging down California’s housing finance system. Forcing developers to jump through state hoops to fill their financing gaps before applying for needed federal resources adds months – even years – to projects, at substantial cost. Realigning resources through a single unified process – creating a “one-stop shop” of sorts – could facilitate faster development of affordable housing, to the benefit of all Californians.

Housing Finance Today

Currently, California’s housing finance system is divided between the governor’s Administration and the State Treasurer’s Office (STO). Leadership on state housing policy resides in the Administration, while the primary funding sources for affordable multi-family housing are administered by STO. This disconnect can make it difficult for the state’s housing finance programs to effectively provide incentives to projects that advance the state’s affordable housing goals.

The California Debt Limit Allocation Committee (CDLAC) will allocate over $4.5 billion in bonds for affordable multi-family housing in 2020. The Tax Credit Allocation Committee (TCAC) will allocate around $5.5 billion in state and federal low-income housing tax credits in 2020. The level of subsidy provided by the Department of Housing and Community Development (HCD) and other housing programs under the governor’s direct control is significantly lower than funding provided by TCAC and CDLAC; HCD historically has not awarded more than $2 billion in affordable multi-family project funding in a single fiscal year.

Controller Yee strongly believes California can and must do better. As outlined in October 2019, California is the only state with housing agencies reporting to separate elected officials. Six of the next 10 largest states have a single agency administering housing programs, allowing for a unified housing finance allocation process.

For example, Minnesota has developed a comprehensive one-stop shop, through which developers of affordable housing apply for almost all state-controlled housing resources in a single application and funding competition. While California is a large and diverse state with unique needs, there is no reason it cannot adopt a unified funding system.

One-Stop Shop

One-Stop Shop

While there are important details to consider, the overall concept of a one-stop shop for housing development is simple. A single state entity would manage the allocation of resources. A single scoring criterion would be applied across all funding programs. Affordable housing developers would apply once per project, and the state would maximize use of its limited resources in a single review process.

Organizational Alignment

Success of this proposal would require allocation of resources to be handled by a single entity overseen by the Administration, which already sets housing policy. TCAC is well-suited to serve this purpose, as it already reviews essentially all affordable housing projects and oversees a public review process. Under Controller Yee’s proposal, the five voting members – who include the state controller and state treasurer – would remain, but the Governor, who appoints a majority of voting representatives, would become the chair. TCAC could then be rebranded as the Housing Allocation Committee.

The housing finance functions currently within HCD would be divided according to this new one-stop shop model. The teams that currently develop program criteria and review funding applications would be housed within the Housing Allocation Committee. The teams that monitor the operation of projects would be separated into a new Department of Housing Compliance. After the state’s awards are made by the Housing Allocation Committee, this single entity would monitor the state’s affordable housing assets. The state employees who currently monitor projects within TCAC would be merged into the new department, reducing duplication.

Housing policy functions would be maintained in a separate department to ensure allocation and compliance actions are in line with ever-changing state housing priorities. The California Housing Finance Agency (CalHFA) would remain independent under its statutory role as the state’s self-funded public housing bank. CalHFA’s excess resources would be used in alignment with and to complement the state’s larger housing policy goals.

Allocation Process

Under Controller Yee’s proposal, California would operate a single, unified competition for state-controlled housing funds as administered by the Housing Allocation Committee. This system would enable the state to fund the best overall projects in each round. A single funding application would be used, and applicants would identify which unique subsidy programs could be used by their project.

Universal scoring criteria would be used to evaluate all projects. This scoring would include a comprehensive evaluation of the state’s funding priorities. The scoring methodology would appropriately reflect the value of these priorities – be it housing for special populations such as homeless Californians, transit-oriented development, or housing that meets certain sustainability criteria. Projects would be encouraged to maximize public benefit versus state investments, and specific project types would not be limited to unique funding sources. If many strong proposals were submitted for veterans’ housing projects, they would be funded not only with Veterans Housing and Homelessness Prevention dollars but other, more flexible, sources.

General program requirements would be aligned; specific requirements could exist for unique priority areas, but all shared requirements would be consistent. This would require statutory changes for various programs created over time. The Housing Allocation Committee would complete a general review to score all project applications according to the new scoring system. A second review would confirm if applications are eligible for the unique programs they have applied for, according to their specific program requirements. The general scoring system would determine which projects are eligible for funding, but staff would determine how best to fill the overall funding gap that remains after federal resources are allocated. This will require closely monitoring the details of different funding streams and pricing to ensure different subsidy programs are treated equitably.

Rather than applying for HCD funding, waiting for the next tax credit application, and reapplying if unsuccessful – which can take multiple years – applicants will apply once, and awardees will know with certainty if they have enough state resources to build their affordable housing projects. Funding competitions would take place twice per year, in line with current awards for the nine-percent tax credit program.

Integrated Data

This proposal requires a consistent data system to track all housing developments funded with state resources. First, a single application portal would be utilized, and the associated data would feed into the single data system. Projects could easily be tracked across funding sources, allowing the state to compare outcomes and measure progress towards its housing goals. An integrated data system also would allow for better tracking of balances of various financing programs, so funds are allocated in a more timely manner. Without a comprehensive data system for the allocation and compliance cycle, even a one-stop shop will not do away with delays in the development of affordable housing.

Time for Transition

A one-stop shop will take time to implement, given the reorganization, alignment of requirements, and application of a single scoring criterion. However, the transition will not slow construction of affordable housing projects in the interim. While other gap funding is on hold, federal resources will continue to be allocated, and California will have an opportunity to catch up on past awards with outstanding funding gaps. Controller Yee believes the time and effort to redesign the system today will pay untold long-term dividends with the benefit of faster development moving forward.

Legislature Faces Full Slate of Issues amid Fiscal Uncertainty

The COVID-19 pandemic continues to affect business at the State Capitol, and procedures remain modified to meet public health guidelines. On December 7, the 2021-22 regular session of the California State Legislature convened and newly elected members took their oath of office, with the State Assembly meeting at the Golden1 Center to allow for adequate physical distancing.

When lawmakers reconvene in January, they will need to address many urgent matters including ongoing pandemic response, preparedness for future emergencies, climate change-induced wildfires, energy resource adequacy, housing and eviction prevention, racial equity and justice, and establishing budget priorities.

Pandemic Response and the Budget

Education and business relief surely will be top priorities, particularly measures that support reopening and economic recovery. In their oversight role, legislators also will convene hearings to evaluate the state’s response to the pandemic, performance of the health care delivery system, use of emergency funds, vaccine distribution, and other response efforts.

California’s fiscal outlook across government remains uncertain, with many variables affecting potential future revenues. Early in the pandemic, California turned to the federal government for assistance. The federal CARES Act provided much-needed relief, but it did not go far enough. The 2020-21 Budget Act included a series of difficult cuts that were to be reversed if the state received an additional $15 billion in federal relief by October 2020. Those funds did not materialize, but revenues are outperforming budget estimates. Improving revenues may lead lawmakers to consider restoring some cuts, but attention must be paid to replenishing the rainy day fund, increasing the budget reserve, adequately funding ongoing pandemic response efforts, preventing wildfires, and strengthening the state’s emergency preparedness. Even if the current positive revenue trend continues, lawmakers will face difficult decisions about where to spend, as the state faces a longer-term structural deficit. Lawmakers are likely to consider revenue-generating measures. Proposition 15, commonly known as “split roll,” was seen as a potential solution to local government funding shortfalls. Analysts predicted it would generate up to $11.5 billion by allowing local governments to reassess property taxes of specified commercial properties annually. With the ballot measure’s November defeat, lawmakers are likely to introduce bills that propose tax increases to ease the longer-term budget uncertainty and gird against future deficits.

California’s fiscal outlook across government remains uncertain, with many variables affecting potential future revenues. Early in the pandemic, California turned to the federal government for assistance. The federal CARES Act provided much-needed relief, but it did not go far enough. The 2020-21 Budget Act included a series of difficult cuts that were to be reversed if the state received an additional $15 billion in federal relief by October 2020. Those funds did not materialize, but revenues are outperforming budget estimates. Improving revenues may lead lawmakers to consider restoring some cuts, but attention must be paid to replenishing the rainy day fund, increasing the budget reserve, adequately funding ongoing pandemic response efforts, preventing wildfires, and strengthening the state’s emergency preparedness. Even if the current positive revenue trend continues, lawmakers will face difficult decisions about where to spend, as the state faces a longer-term structural deficit. Lawmakers are likely to consider revenue-generating measures. Proposition 15, commonly known as “split roll,” was seen as a potential solution to local government funding shortfalls. Analysts predicted it would generate up to $11.5 billion by allowing local governments to reassess property taxes of specified commercial properties annually. With the ballot measure’s November defeat, lawmakers are likely to introduce bills that propose tax increases to ease the longer-term budget uncertainty and gird against future deficits.

Housing and Eviction Prevention

As it has with other issues, the pandemic has amplified California’s housing crisis. While Assemblyman David Chiu’s AB 3088 (Chapter 37, Statutes of 2020) prohibits evictions through January 31 for some tenants, a longer-term solution is needed urgently to protect people who cannot make housing payments due to pandemic-related loss of income. Potential solutions include Assemblyman Chiu’s AB 15 and AB 16, which would extend the eviction moratorium another 11 months and create a rental assistance program for tenants and property owners.

Earlier this year, Governor Gavin Newsom launched Project Roomkey, which relies on emergency federal funding to shelter homeless residents in hotels, as well as Project Homekey, which provides funding to convert temporary housing units into permanent housing for homeless people. The legislature will need to consider providing additional funding to expand these programs. Long-term solutions also must be adopted, with a focus on removing barriers to housing production, addressing affordability, and ending homelessness. Effective strategies can be developed and implemented with the combined efforts of state and local stakeholders. Controller Yee is once again calling on the legislature to explore creation of a unified state housing agency to streamline the state’s housing programs.

Broadband Infrastructure and Connectivity

Although California has long been at the forefront of technological innovation, COVID-19 stay-at-home orders have put a spotlight on the state’s own technological infrastructure, illuminating inequities in accessibility that exacerbate the impact of the pandemic on rural, low-income, and underserved communities. More than 20 percent of Californians live in impoverished or remote areas that are unconnected or underconnected to the internet. For many, this means the affordable, reliable high-speed internet needed for educational instruction at home, remote work, telehealth, e-mental health, business transactions, and social connection is not accessible.

Never has there been more urgency to close the Golden State’s digital divide. California’s current bandwidth and infrastructure have been unable to accommodate six million school-aged children, many of whom may have to continue distance learning for the foreseeable future. Countless adults who need connectivity to perform their jobs remotely also are affected. While increased reliance on telemedicine has helped improve physical and mental health care access and delivery, these innovations mean nothing to the millions without internet access.

Assemblywoman Cecilia Aguiar-Curry has introduced Assembly Bill (AB) 14 to prioritize the deployment of broadband infrastructure in California’s vulnerable and unserved communities, by extending the funds in the California Advanced Services Fund to leverage grants necessary to bridge the digital divide. This will help lay the infrastructure for California's economic recovery and permanent changes to the delivery of education, health, business, and banking services to our most vulnerable communities.

Details still are being developed, but AB 34 (Muratsuchi) has been introduced as a spot bill to place the California Broadband for All Bond Act on the November 2022 ballot, asking voters to approve general obligation bonds of up to $10 billion to improve California’s broadband infrastructure statewide.

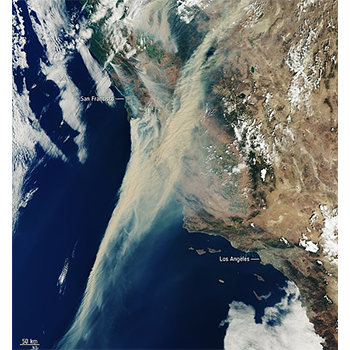

Climate Change and Wildfire Response

While the pandemic has dominated the legislature’s attention in 2020, climate change remains an existential threat that affects every Californian – from rapid sea-level rise threatening our coastal and other populations, to raging wildfires that have decimated entire communities, to an overreliance on plastics that has compromised the health of our oceans. Lawmakers have already introduced bills to address these issues: Senate Bill (SB) 1 (Atkins) seeks to mitigate the impact of sea-level rise; SB 45 (Portantino) asks voters to approve a bond to finance wildfire prevention projects; and SB 54 (Allen) looks to drastically reduce the amount of plastic packaging entering California’s waste stream.

Workforce Protections

Pandemic-related workplace safety will be top of mind for many lawmakers. Controller Yee expects to see bills aimed at protecting low-wage, frontline workers and preventing the spread of COVID-19 in the workplace, as well as policies protecting the rights and benefits of teleworking employees.

With voter approval of Proposition 22, drivers for app-based transportation and delivery companies will be classified as “independent contractors,” exempting those companies from providing the benefits required under AB 5 (Gonzalez, Chapter 296, Statutes of 2019). This exemption is expected to lead to efforts to exempt employers in other industries. While each situation is unique, the battle over labor laws and discussions relating to the future of independent work will continue. Controller Yee is hopeful lawmakers will proceed cautiously and focus on protecting the welfare of California workers.

Racial Equity and Justice

Racial Equity and Justice

In the wake of the killing of George Floyd, numerous policing reform bills were introduced in the last legislative session. However, most of those measures stalled. Lawmakers have begun to reintroduce similar policing reform proposals. SB 2 (Bradford) would create a statewide process to revoke the certification of a peace officer convicted of serious crimes or terminated from employment due to misconduct. AB 26 (Holden) would require law enforcement officers who observe excessive force to intercede and to report it immediately. AB 48 (Gonzalez) would limit the usage of certain less-lethal weapons by law enforcement, such as rubber bullets and pepper spray.

In November, voters rejected Proposition 16, which would have repealed the state constitutional ban on affirmative action. This will be on the minds of lawmakers as they debate solutions to longstanding issues around race and inequality and seek to enact policies that ensure diversity in our educational system and government contracting, as well as equity across all policy areas.