You can also view this newsletter as a PDF.

Nature Contributes Vital, Low-Cost

Climate Solutions to Meet Ambitious Goals

The effects of climate change are here and worsening. The atmosphere already is filled with untenable levels of carbon dioxide and other greenhouse gases, and more are emitted every day. Climate change is affecting ecosystems, economies, and communities, and it must be addressed from every angle.

Climate change has been a major target of policy interventions, internationally and in California. Ambitious and necessary goals are in place. Focused actions subsequent to the Paris Agreement of 2016 aim to keep the global temperature from rising 1.5 degrees Celsius above pre-industrial levels. California committed in Chapter 249, Statutes of 2016 to reducing its overall greenhouse gas emissions by 40 percent from 1990 levels by 2030. Reaching these benchmarks is a challenge that requires an “all of the above” approach.

Climate solutions often rely on technological changes to reduce carbon emissions and transition industries from fossil fuels to renewable energy. High-profile examples include electric vehicles and solar panels. Technological solutions will continue to play a key role in reducing carbon emissions and should be prioritized. However, another vital strategy that deserves greater attention is nature-based climate solutions. Sometimes called “natural solutions,” they include conservation, restoration, and improved land management that increases carbon storage or reduces greenhouse gas emissions in landscapes and wetlands.

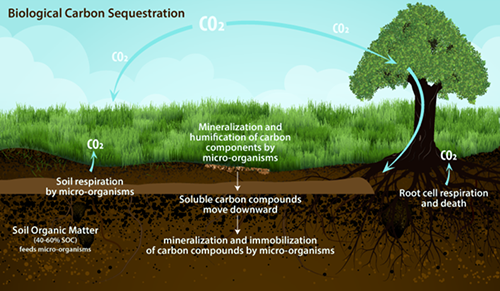

Forests and soils store carbon; investing in their stewardship is an investment in combating climate change. Other nature-based investments include wetlands restoration, reforestation, fire management, and reform of agricultural practices. Many solutions can be implemented or expanded with existing technology and with less expense than investments in developing technology.

Forests and soils store carbon; investing in their stewardship is an investment in combating climate change. Other nature-based investments include wetlands restoration, reforestation, fire management, and reform of agricultural practices. Many solutions can be implemented or expanded with existing technology and with less expense than investments in developing technology.

Within nature-based climate solutions, forestry practices provide great opportunity to mitigate climate change. A recent study published in Science Advances found that, in the U.S., reforestation has the highest potential of all climate solutions. Natural forest management was second. These practices already are part of California’s climate change response; the majority of offset credits issued through the cap-and-trade program are for forest projects.

Nature-based mitigation opportunities also abound in agriculture. For example, carbon can be sequestered in farmland by using cover crops in times when fields would otherwise be bare. These investments produce additional ecological benefits – like increased biodiversity – and improve farmland by adding nutrients to the soil. California recently invested in these efforts through the Healthy Soils Program, funded by the cap-and-trade proceeds collectively referred to as California Climate Investments.

There also are nature-based solutions for helping people adapt to climate change. One promising California example is wetlands restoration that will help coastal communities adapt. Restoring wetlands, oyster beds, and dune features can increase coastal resilience to sea-level rise by slowing water and creating a buffer from storms and flooding. Wetlands restoration also produces habitat and water filtration benefits, and it sequesters carbon. These strategies were highlighted by the Ocean Protection Council, of which Controller Yee is a member, in its recent strategic plan.

Beyond tangible environmental benefits, sustainable management and use of natural resources produce economic and community benefits. For example, investing in forest management and reforestation creates new skilled jobs that will be needed for the forseeable future, while better positioning forest communities to weather fires and other natural disasters that have been exacerbated by climate change. Nature-based climate solutions involve people in communities restoring degraded natural resources to improve the resilience and health of communities while helping to tackle the global climate crisis. Solutions that simultaneously tackle the climate crisis, provide opportunities for meaningful work, and protect communities are exactly the kind we need.

Credit Rating Agencies Move Local

Governments to Address Climate Risk

California is enduring yet another year of “once-in-a-generation” wildfires that have cost lives, destroyed billions of dollars’ worth of property, and dramatically worsened air quality from San Diego to Seattle. At the same time, scientists again have raised the alarm about huge ice sheets in Greenland melting and drifting away from the North Pole, threatening to flood coastal communities.

As California leaders work to develop a strategy – and identify funding – to address these challenges, local governments also must assess their risk and begin to plan for the future. Credit rating agencies have begun incorporating climate change and sustainability factors into their ratings of states, counties, and cities nationwide, accelerating progress on this front. After a series of wildfires and hurricanes three years ago, Moody’s Investors Service, Standard & Poor’s (S&P), and Fitch Ratings all issued reports warning state and local governments their credit ratings could be impacted based on their exposure to climate risk.

Investors rely on this type of assessment to determine whether the physical assets they are financing through the purchase of bonds will survive a natural disaster. The rating risk assessment also evaluates potential impacts on the local tax base in the event a climate event devastates a community. In addition to affecting the ability to rebuild crucial public infrastructure, such as schools, extreme climate-related losses could threaten repayment of the bond debt service.

Last year, Moody’s purchased a majority share in Four Twenty Seven, a California-based company that measures the physical risks of climate change impacts including extreme rainfall, hurricanes, heat stress, and sea-level rise. The data track impacts on 196 countries and 2,000 companies, as well as 761 U.S. cities and 3,000 counties.

S&P uses data analysis and climate change scenarios from Trucost, an S&P Global subsidiary, as a starting point in their discussions with state and local issuers on how they view climate risk and their plans to address it. A recent report by S&P points to the ongoing analysis and resulting discussions as important to evolving climate risk disclosures from issuers. They indicate the COVID-19 pandemic is “helping to (re)focus investors and decision-makers to the possible severe impacts of a ‘green swan’ event.”

Analysts believe enhanced data analysis can focus issuers on:

- Climate risk adaptation and mitigation plans;

- Potential long-term economic and demographic consequences on tax bases;

- Adequacy of reserve or financial capital to respond to increasingly volatile environmental conditions; and

- Potential increased costs to finance infrastructure projects to address climate risk.

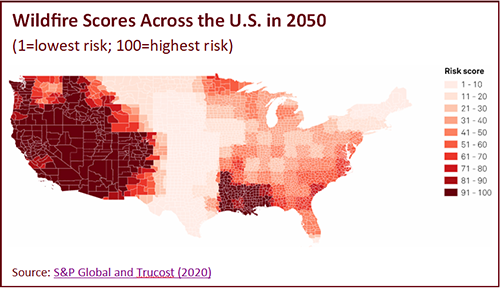

The S&P report also notes that the lack of standardized reporting for public issuers facing similar climate risks makes it more difficult to rate and led to the development of conflicting scenarios by independent data providers. Some of the climate risk scenarios developed by Trucost show that 38 percent of U.S. counties score the maximum risk core for water stress, and 50 percent have high risk. The data show the western states have a maximum score for wildfire risk.

The S&P report also notes that the lack of standardized reporting for public issuers facing similar climate risks makes it more difficult to rate and led to the development of conflicting scenarios by independent data providers. Some of the climate risk scenarios developed by Trucost show that 38 percent of U.S. counties score the maximum risk core for water stress, and 50 percent have high risk. The data show the western states have a maximum score for wildfire risk.

Fitch Ratings has begun publicly disclosing how environmental issues like climate change are incorporated into municipal ratings. At this point, however, their focus is on helping investors understand environmental, social, and governance factors.

As investors begin to assess financial impact on their holdings from climate risk, there is more pressure on rating agencies and issuers to disclose risks and devise plans to mitigate impacts. Controller Yee serves on the board of Ceres, a nonprofit organization working with investors and companies on climate change. The organization recognized these pressures in June when it released Assessing Climate as a Systemic Risk: A Call to Action for U.S. Financial Regulators, a report targeting actions financial regulators should take to strengthen climate risk disclosure. In the report, Ceres suggested the U.S. Securities and Exchange Commission (SEC) should encourage credit rating agencies to disclose more information about how they factor climate risks into rating decisions. Ceres says the SEC could also change their own practices to summarize their findings on the extent to which credit raters consider climate risk in annual examination reports.

It is crucial that credit rating agencies strengthen their climate-risk analysis and accurately characterize it in their credit assessments of local issuers. Widespread adoption of a universal disclosure framework – over which credit rating agencies could have tremendous influence –would help state and local issuers analyze, disclose, and plan to mitigate their climate-related risk.