You can also view this newsletter as a PDF.

Tax Season Brings New Credits and

Requirements; Filing Assistance Available

The California Franchise Tax Board (FTB) and Internal Revenue Service (IRS) now are accepting 2019 tax returns. This tax season, FTB expects to process 20 million personal income tax (PIT) returns, and the IRS expects to process more than 150 million PIT returns. The deadline to file a 2019 PIT return and pay taxes is April 15.

Earned Income Tax Credits and Young Child Tax Credit

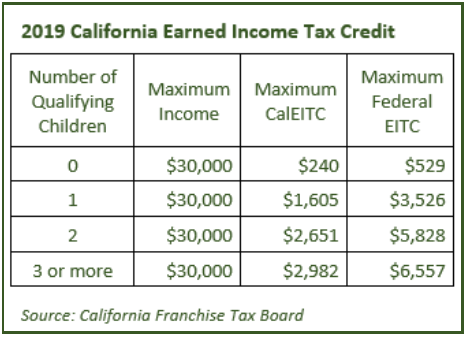

Eligibility for the California Earned Income Tax Credit (CalEITC) has been expanded. People who earned less than $30,000 in 2019 — including through self-employment — may qualify, and those who also have a child under age six may be eligible to claim the Young Child Tax Credit (YCTC). Between CalEITC and YCTC, FTB anticipates returning $1 billion to taxpayers this year. Taxpayers earning less than $55,952 also may qualify for the federal EITC. Through a combination of CalEITC, YCTC, and the federal EITC, a family can receive up to $8,053.

Eligibility for the California Earned Income Tax Credit (CalEITC) has been expanded. People who earned less than $30,000 in 2019 — including through self-employment — may qualify, and those who also have a child under age six may be eligible to claim the Young Child Tax Credit (YCTC). Between CalEITC and YCTC, FTB anticipates returning $1 billion to taxpayers this year. Taxpayers earning less than $55,952 also may qualify for the federal EITC. Through a combination of CalEITC, YCTC, and the federal EITC, a family can receive up to $8,053.

Volunteer Income Tax Assistance and CalFile

One small challenge getting these cash-back credits: You have to file a tax return to claim them. Many who qualify do not file because they do not meet the income tax filing threshold. Income-eligible Californians who need help filing a PIT return can find it through the Volunteer Income Tax Assistance (VITA) program at sites statewide until April 15. All VITA volunteers are IRS-certified and can be trusted not to charge money for their services.

FTB offers free electronic filing for state tax returns through CalFile, an easy-to-use tool that allows many taxpayers to file directly with FTB and provides instant confirmation when the return is received.

2019 Tax Season Results for 2018 Returns

The tax programs administered by FTB – PIT and corporation taxes – comprise more than 70 percent of the state government’s General Fund. During the 2019 filing season, FTB processed 19.8 million PIT returns, with roughly 95 percent being for the 2018 tax year. In addition, 2.1 million business entity returns were received. More than 13 million personal and business entity returns resulted in refunds totaling more than $17 billion. There were 2.1 million CalEITC claims, which topped the 2018 tax season by 40 percent. The total value of CalEITC for last year’s tax season was $397 million.

Customer Services

Throughout the year, FTB communication channels provide services and information to help taxpayers file accurate and timely tax returns and pay the proper amount owed. The MyFTB service allows taxpayers to view their tax documents, check balances due, access tax calculators, and send secure messages to FTB staff. It normally takes up to two weeks to receive a refund for an electronically filed return and up to four weeks for a paper return. The Where’s My Refund tool allows taxpayers to check the status of their refunds. In the 2019 tax filing season, taxpayers accessed MyFTB and Where’s My Refund each more than three million times.

Gig Economy and Worker Classification

The gig economy – otherwise known as the sharing economy or access economy – comprises people earning income by providing on-demand work, services, or goods, often through a digital platform. The income from this activity is taxable and must be reported on a tax return, even if the income is:

- From part-time, temporary, or side work;

- Not reported on an information return form such as a 1099-K, 1099-MISC, W-2, or other income statement; or

- Paid in any form including cash, property, goods, or virtual currency.

With recent changes to California law addressing worker classification, including Assembly Bill 5 (Chapter 296, Statutes of 2019), the California Labor and Workforce Development Agency offers answers to some frequently asked questions.