You can also view this newsletter as a PDF.

Pension Funds Gird Against

Market and Fed Rate Volatility

During the last four months of 2018, financial markets were extremely volatile. This year, turbulence hit in July before markets stabilized and resumed growth by late September. Despite record-setting highs in the S&P 500 and Dow Jones indices, most investors expect the 11-year economic expansion to end soon.

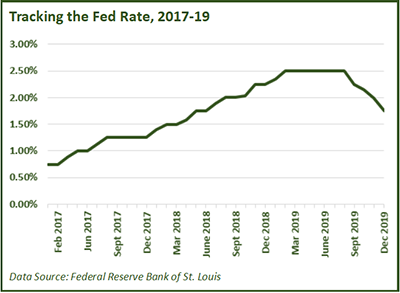

Likewise, the Federal Reserve’s actions in recent years have been somewhat volatile. During the last recession, the Federal Open Market Committee (FOMC) lowered the federal funds rate (the rate at which banks borrow money from each other) to 0.25 percent to stimulate economic growth. The rate remained at that level through late 2015 when FOMC began increasing it gradually. In 2018, FOMC acted decisively, raising the federal funds rate four times from 1.5 percent to 2.5 percent to guard against inflation and provide room in the rate for cuts to prop up the economy during the next downturn.

Likewise, the Federal Reserve’s actions in recent years have been somewhat volatile. During the last recession, the Federal Open Market Committee (FOMC) lowered the federal funds rate (the rate at which banks borrow money from each other) to 0.25 percent to stimulate economic growth. The rate remained at that level through late 2015 when FOMC began increasing it gradually. In 2018, FOMC acted decisively, raising the federal funds rate four times from 1.5 percent to 2.5 percent to guard against inflation and provide room in the rate for cuts to prop up the economy during the next downturn.

FOMC changed course in 2019, cutting the rate three times to 1.75 percent in an effort to maintain the moderate growth outlook and steady markets after trade talks broke down. As expected, FOMC maintained the rate at this month’s meeting and indicated they will continue to monitor financial data and potential economic risk from a new round of tariffs on Chinese goods. Inflation is another data point FOMC continues to track; a sharp increase beyond the 2.0 percent inflation target could lead to a federal funds rate increase. Other key considerations include a sharp drop in gross domestic product or consumer spending, or a significant change in the labor market. The 2020 presidential election also could factor into FOMC decisions.

The California Public Employees’ Retirement System (CalPERS) and California State Teachers’ Retirement System (CalSTRS) closely monitor financial markets and public equity volatility. Over the last few years, the pension funds have adopted asset allocation strategies to reduce the risk of another large downturn and avoid a repeat of double-digit negative returns. Both funds have invested half of their portfolios in public equity, which provides opportunity for strong returns in a good market. However, large market losses could put additional pressure on employer contributions or lower the funded status.

CalSTRS has invested $22.3 billion, or approximately 9 percent of the total fund, in a Risk Mitigating Strategies (RMS) Portfolio designed to act as a hedge against a volatile stock market by creating a floor for potential negative returns. This strategy was tested at the end of 2018 when the RMS portfolio outperformed the MSCI All Country World Index, providing some protection against a steep downtown.

CalPERS also is looking at strategies to ensure the fund has enough liquidity to pay benefits and invest in assets at attractive prices. Over the past year, staff moved $54 billion from traditional passive cap-weighted equity strategies (which select investments in companies based on their market share) to factor-based strategies that select stocks based on inputs such as long-term past performance or whether the stock is undervalued. Staff believe this approach helped them mitigate losses in the 2018 market decline and could serve as a hedge to lessen potential losses in future market drawdowns.

The Wayfair Decision and California’s Economic Nexus

On June 21, 2018, the United States Supreme Court ruled a state can require businesses without a physical presence in that state to collect and remit sales taxes on in-state transactions if the business has a substantial nexus.

In its 5-4 decision in South Dakota v. Wayfair (Wayfair), the Supreme Court ruled a nexus may be based on both economic and virtual contacts, and the amount of in-state economic activity required by South Dakota law — more than 200 transactions or $100,000 in in-state sales — satisfies the substantial nexus requirement established in Complete Auto Transit v. Brady (1977).

In response to the Wayfair decision, the California Department of Tax and Fee Administration (CDTFA) issued a notice in December 2018 using the same standards as the South Dakota statute. Under the notice, retailers with sales of more than $100,000 in California in the current or previous calendar year, or who entered into 200 or more transactions in the state in that timeframe, were required to register as retailers with CDTFA and collect and remit the use tax effective April 1, 2019.

However, the California Legislature in April 2019 sought to limit economic nexus for California use tax purposes. Assembly Bill 147 (Chapter 5, Statutes of 2019) amended Revenue and Taxation Code (RTC) section 6203 to require that retailers located outside of California (remote sellers) register with CDTFA and collect California use tax only if, during the preceding or current calendar year, total combined sales of tangible personal property for delivery in California by the retailer and all related persons exceeds $500,000. This economic nexus with California took effect April 1 and does not include a transactions threshold.

However, the California Legislature in April 2019 sought to limit economic nexus for California use tax purposes. Assembly Bill 147 (Chapter 5, Statutes of 2019) amended Revenue and Taxation Code (RTC) section 6203 to require that retailers located outside of California (remote sellers) register with CDTFA and collect California use tax only if, during the preceding or current calendar year, total combined sales of tangible personal property for delivery in California by the retailer and all related persons exceeds $500,000. This economic nexus with California took effect April 1 and does not include a transactions threshold.

The new law also amended RTC section 7262 to require all retailers, whether located inside or outside of California, to collect district use tax on all sales made for delivery in any district that imposes such a tax if, during the preceding or current calendar year, the total combined sales of tangible personal property in – or for delivery in – California by the retailer and all related persons exceeds $500,000. This new collection requirement took effect April 25.

As of October 1, the Marketplace Facilitator Act created by AB 147 and amended by Senate Bill 92 (Chapter 34, Statutes of 2019) provides that a marketplace facilitator is responsible for collecting and paying tax on retail sales made through their marketplace for delivery to California customers. A marketplace includes a physical or online site where tangible merchandise is sold for delivery in California. A marketplace facilitator generally is the operator.

These changes are projected to increase revenue by $309 million in Fiscal Year 2019-20 and $476 million in FY 2020-21.